Minimal advance payment necessary for a loan ‘s the largest challenge to buying property. Even if you see your income is more than enough to assistance their mortgage repayments, you do not have sufficient stored to your large 20% down-payment one certain mortgages require. A lot of people take a look at the assets and you may believe getting currency aside of its 401(k) are a quick and easy type conference which demands. But not, there are various conditions and you can disadvantages to look at prior to withdrawing out-of the 401(k).

What is a 401(k)?

An effective 401(k) is actually a pals-paid senior years account. Its named their 401(k) once the foundation for it coupons package is the 401K supply on Irs code. Personnel lead element of its wages, and many companies is also matches they. Instead of bringing a reliable rate of interest, you need to dedicate your 401(k) discounts to your ties (holds, securities, ETFs, REITs, etcetera.) to make a return. 401(k) levels has three fundamental benefits to encourage individuals to create benefits.

- People earnings resulted in a good 401(k) is http://www.elitecashadvance.com/loans/emergency-payday-loan not taxed

- Any returns produced into investments out of your 401(k) commonly taxed

- Companies may match efforts both partly or fully

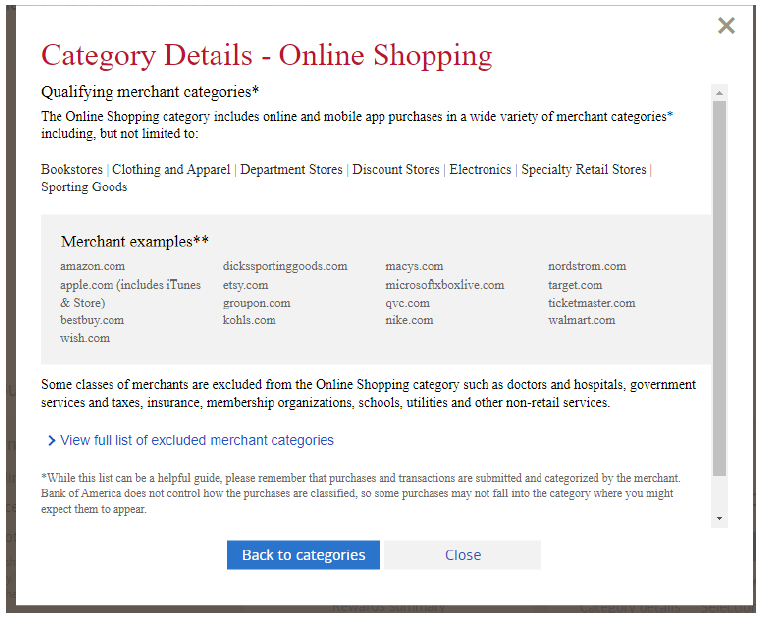

Although not, this type of advantages do not occur without caveats. Government entities does not want your 401(k) are a better income tax-100 % free checking account (TFSA). Alternatively, government entities sets specific limitations and charges toward early distributions so you can remind enough time-name using for retirement. These penalties through the 10% withdrawal payment for an earlier detachment. And the fee, the fresh taken count are subject to income tax. Another dining table helps you discover whether or not you could potentially withdraw money without the punishment.

For-instance regarding an early withdrawal penalty, imagine you really need to withdraw $fifty,000 to purchase down-payment. By the ten% penalty, the newest 401(k) balance usually disappear because of the $55,100. Simultaneously, the fresh $50,100 which were taken could be subject to tax, so that the holder of the membership would need to also spend income taxes within these $50,100.

Since bodies discourages very early distributions from your 401k, you have access to the cash involved playing with one or two different ways.

1. 401(k) Finance

A good 401(k) mortgage try a great self-issued mortgage, and that means you acquire from the 401(k) and costs return to your account. Typically, the maximum financing term are five years, but this is exactly extended whether your loan is employed so you’re able to purchase a principal residence. Having a good 401(k) mortgage, your steer clear of the ten% very early detachment penalty, as well as the matter won’t be subject to income tax. The us government performs this as you need to repay on your own, so you continue to be preserving for your retirement.

- Stop early withdrawal penalties

- The bucks output for your requirements, and also you continue to help save having later years

- 401(k) financing loans isnt factored into your Debt-To-Money (DTI) ratio

- Incapacity in order to meet money does not apply to your credit score

- Must be paid with notice (typically the Best Price + 2-3%)

- No additional benefits during the loan identity (appeal repayments commonly efforts and are also unmatched by your employer)

dos. 401(k) “Hardship” Detachment

For people in age 59?, a great hardship withdrawal otherwise very early withdrawal out of your 401(k) was welcome around special circumstances, which happen to be on the Irs Difficulty Distributions page. With your 410(k) for a downpayment to your a primary home is categorized while the a trouble withdrawal. By opting to use a trouble withdrawal, you are going to need to afford the ten% early detachment punishment, and therefore matter is noticed nonexempt income. Exceptions take the official Internal revenue service webpage. Basically, such exclusions are hard so you’re able to qualify for, thus a good 401(k) mortgage can be greatest.