When the founders of Hubspot Brian Halligan and Dharmesh Shah conceived their inbound marketing startup in 2004. They were still graduate students at MIT, and inbound marketing was not well understood. They were able to develop this idea into a successful company and eventually went public in 2014. Today, the Boston-based company has a market cap of over $30 billion.

There were several elements that contributed to achieving positive results. The founders met at one of the world's leading universities. They had an idea, but they were in a place that nurtured ideas, in an area with experienced investors who saw the company's potential. This gave them the ability to raise capital, improve their plans, and grow the company. All of this was possible because they were in the Boston area.

Every city needs a success story like Hubspot, but Boston has many others including iRobot, Wayfair, Acquia, and Carbon Black, to name a few. Just last year, Klaviyo went public, adding to the parade of startup success stories. Some were purchased. Some went public. But they all showed what is possible for the many people who dream of building a successful business in the Boston area.

As these companies generate wealth for the founders, this in itself provides an angel funding system where the founders with cash coming out of their exits support a new generation of founders, and this virtuous cycle of wealth generation continues. Moreover, these companies also produce other entrepreneurs, who leave and start their own companies, often receiving financial support from their old bosses.

In the lead-up to our early stage event in Boston on April 25, I spoke with some local Boston investors and advisors to help paint a picture of what makes Boston's startup ecosystem so successful.

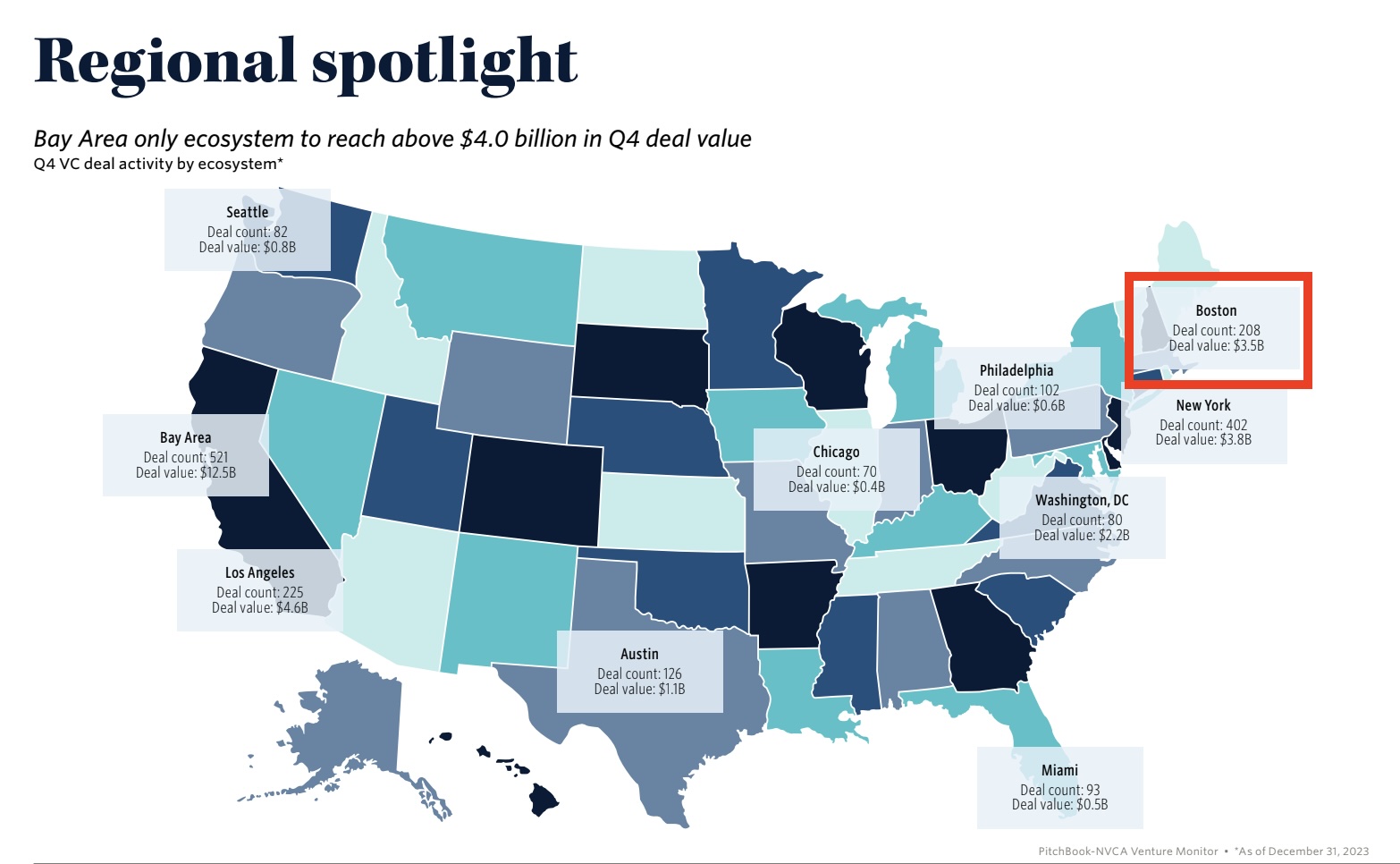

Although there are many dimensions to a successful business ecosystem, we tend to look at dollars invested to measure how well an area is performing. When we talk about Boston, the city is only part of it. It's really a regional or even statewide perspective, but however you look at it, PitchBook calculates VC dollars and puts the Boston area fourth nationally in the fourth quarter of 2023. For a small city in a small state, that's pretty impressive.

Join us at TechCrunch Early Stage in Boston this month to hear Lily Lyman, Emily Knight, Rudina Seseri, and other top founders and investors talk about essential startup skills. Register today!

Two of the other four are in California. San Francisco (to no one's surprise) leads the way, followed by New York City, Los Angeles, and then Boston. In the last quarter of 2023, Boston concluded 208 deals worth $3.5 billion in total investments in the region.

How does Boston punch above its weight when it comes to venture investing? Emily Knight is president of The Engine Accelerator, an MIT company that works with founders trying to turn big ideas from research labs into startups, sometimes known as “hard tech.” She says it's a combination of factors, starting with the 35 colleges and universities in Boston alone. When you expand the map to include the Boston metropolitan area, which includes Cambridge, it grows to 44 and adds Harvard, MIT, and Tufts to the list.

She says that these universities are fertile ground for new ideas. “There is a lot of research and a lot of emerging innovations that are being translated into companies coming out of these universities,” she said.

Image credits: Pitchbook

Lily Lehman, a partner at Underscore VC, a Boston-based investment firm, says the university system is the main reason her company decided to launch its business in Boston. “It's a big piece of the puzzle, and frankly, it's a big reason why we're here in Boston and why we're bullish about Boston,” Lehman said. In fact, about a third of Underscore's portfolio came directly from the region's university system, with a heavy focus on Harvard, MIT, and Northeastern.

This leads to a second element related to the pure talent that comes out of all these schools. The talent piece is very important and there is no shortage of STEM students constantly flowing out of these schools,” says Rodina Cecere, managing director at Glasswing Ventures.

“If you just think about raw talent, and then look at where AI and machine learning talent is coming from, you'll find that there's an amazing talent pool, which aligns well with my company's investments in enterprise and cybersecurity, and this area has done well,” she said. “Very much in this regard.”

When you put it all together, Lehman says, you get some of the basic elements of a successful startup ecosystem. “The combination of technology and R&D that happens here and the talent that comes here is unparalleled,” she said.

This doesn't mean Boston doesn't lack some amenities, especially for young founders, that are available in larger cities. These limitations have been well documented. There's a shortage of affordable housing, the public transportation system is collapsing, traffic is bad, bars close at 2 a.m. — and the city, in its Yankee modesty, is not good at promoting itself.

Although Boston may face some restrictions, each city has its own issues, Cecere says. What's really important, she says, is providing a place where startups can thrive. “What we can influence is how friendly and supportive we are to entrepreneurship. From providing free spaces to more and more areas for incubators, accelerators and discovery, to providing access to customers and platforms that can accelerate innovation,” she said.

There are already a number of incubator and accelerator programs such as Mass Challenge, Greentown Labs, IDEA, Roxbury Innovation Center, and others that provide a place to nurture early-stage ideas.

What Boston may lack in nightlife, it certainly makes up for in brain power and a long history of startup success. As Cecere says, success breeds success.

“I would say more than anything else we need to support more founders. We need to support more successes. We need those successes so the wheel keeps turning at a faster rate,” she said.