a

Andrew Caballero Reynolds | AFP | Getty Images

The growth rate of housing prices is slowing.

U.S. home prices rose 0.6% from the previous month in February, in line with the average monthly gain of 0.6% in the eight years leading up to the COVID-19 pandemic, according to a new Redfin analysis.

Before the pandemic, it was normal for prices to grow about half a percent each month, or increase about 5% or 6% annually, said Darryl Fairweather, Redfin's chief economist.

“We are back in that trend, despite higher mortgage rates,” she said.

More personal finance:

What might a $418 million settlement on home sale commissions mean for you?

The research found that in 2023, listings in that time frame sold for an additional $7,700

What to know about condo and co-op apartments

A similar trend has emerged in Moody's Analytics' home price index, said Matthew Walsh, associate director and economist at Moody's Analytics.

He added: “House prices are rising at the same pace as before.” “It's back to the trend we saw before the pandemic.”

However, experts say today's market is vastly different from what it was two to eight years ago. The average home is still unaffordable for most potential buyers, while inventory has improved slightly but not enough to meet demand.

“The feeling we get from our agents is that neither sellers nor buyers are happy with this market,” Fairweather said. “Sellers are unhappy…with the offers they are receiving. Buyers are disappointed with rising prices and rising mortgage rates.”

Transaction levels are at “recession troughs.”

While the housing market has stabilized in terms of price growth, the main difference between the market today and the pre-pandemic period is the relatively lower number of transactions, which is largely due to higher mortgage rates, Fairweather said. Mortgage rates peaked at about 8% last year, but are still more than 6%, according to Freddie Mac data.

Walsh said the level of transactions is actually at “recession lows” despite the “data being up in February.”

Another factor affecting sales is the very limited supply of homes, he added.

Redfin found that new listings rose 5% over the past four weeks ending March 17, the largest year-over-year jump since May 2023. “But it's like a little recovery from rock bottom,” Fairweather said.

“We are not back to where we were before the pandemic,” she said.

Economists say supply growth is mostly linked to the seasonal trend. Owners often put their homes up for sale in February because they prefer to move in the spring and summer, Walsh said.

And sometimes life happens. “Another factor is that people need to move either to get a new job or they're getting married, or there's another big life event,” Fairweather said.

The rate locking effect loosens its grip

The mortgage rate fixing effect, also known as the golden handcuffs effect, prevented homeowners with very low mortgage rates from listing their homes last year: They didn't want to finance a new home at a much higher interest rate. Economists say this is now loosening its grip on the market and boosting available supply slightly.

“It was definitely keeping people in place, but the more time passed, the less strong that effect became,” Fairweather said.

Some buyers who have put off listing their homes are “accepting higher mortgage interest rates,” Walsh explained, because they feel they can no longer put off the move.

While the impact of interest rate stabilization is still playing a role in today's stock decline, it will fade further over time, especially as the Federal Reserve decides to cut interest rates later this year, Fairweather said.

Mortgage rates are also expected to decline modestly this year as the Federal Reserve lowers interest rates, while home prices are likely to remain flat or unchanged nationally, Walsh said.

The new builds are getting a little better

New home sales are at the high end of the range seen before the pandemic, averaging about 600,000 per month, Walsh said. 661,000 new homes were sold in January, 1.5% more than in December, according to the US Census Bureau.

Buyers frustrated by the limited supply of existing homes are giving a boost to the new home market. “Construction companies are definitely benefiting from that,” he said.

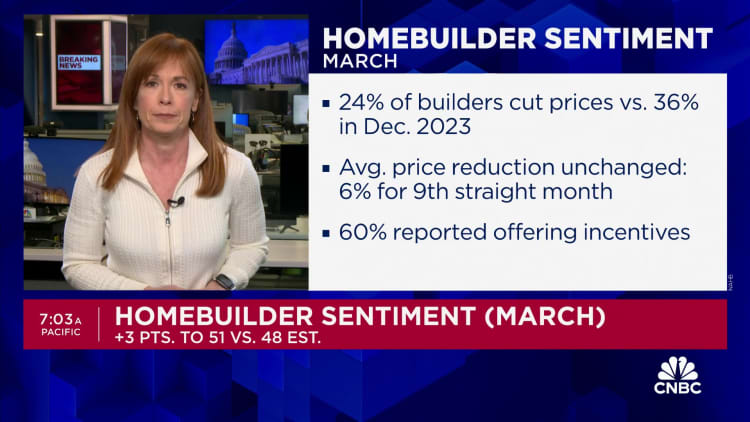

Homebuilders can also offer incentives to buyers that homeowners may not, such as lower mortgage interest rates or rate reductions, Walsh added.

However, this increase is not enough to support the acute housing supply across the country. “It will take some time to make up for this gap, even though they are building more than before,” he added.