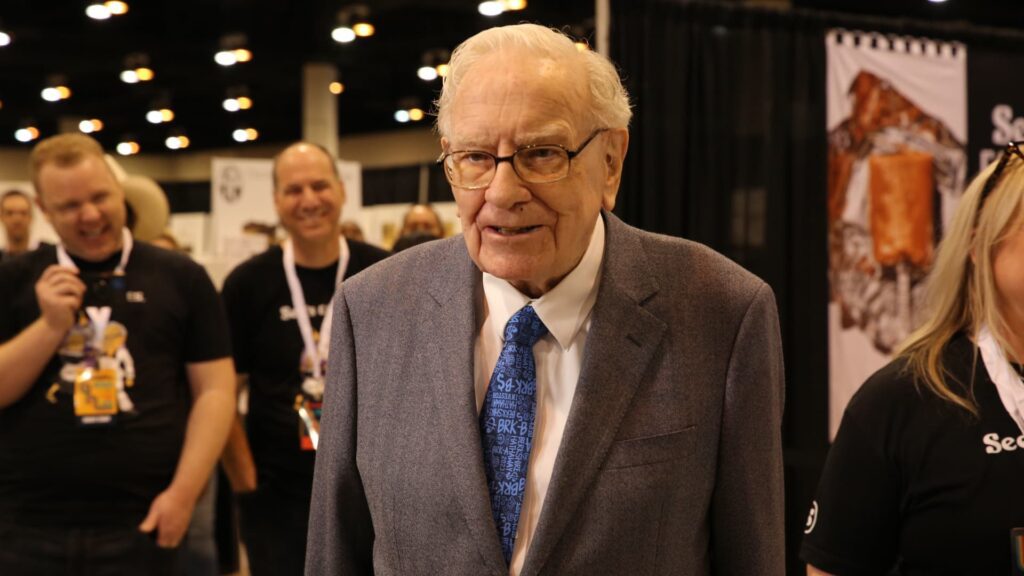

Warren Buffett tours Berkshire Hathaway's annual shareholders meeting headquarters in Omaha, Nebraska.

David A. Grosjean | CNBC

Warren Buffett shared a heartfelt tribute to the late Charlie Munger, describing his business partner of 60 years as today's engineer. Berkshire Hathaway.

In his must-read annual letter on Saturday, the 93-year-old “Oracle of Omaha” explained the instrumental role Munger played in helping him expand his collection and reflected on his fruitful and loving relationship with his right-hand man.

“In effect, Charlie was the ‘architect’ of today’s Berkshire, and I acted as the ‘general contractor’ to implement his day-to-day vision,” Buffett wrote. “Charlie never sought credit for his role as creator, but instead allowed me to bow down and take accolades. In a way, his relationship with me was part big brother, part loving father.”

Munger died in November, about a month before his 100th birthday. Munger's investment philosophy influenced the young Buffett, giving rise to the sprawling conglomerate today worth $900 billion. Buffett recalled the beginning of the acquisition of Berkshire, then a textile manufacturer, and how Munger instilled in him a blueprint for turning the company around.

“Warren, forget about buying another company like Berkshire,” Charlie advised me in 1965 right away. But now that you control Berkshire, add to it great companies bought at fair prices and stop buying fair companies at great prices. In other cases, “Oh my God, unlearn everything you learned from your hero Ben Graham. It works but only when practiced on a small scale.” “With much pushback, I then followed his instructions,” Buffett wrote in the letter.

Buffett studied under the legendary father of value investing, Benjamin Graham, at Columbia University after World War II and developed an unusual talent for picking penny stocks. It was Munger who made him realize that this investment strategy could go no further, and if he wanted to expand Berkshire in a big way, it would not be enough.

“Many years later, Charlie became my partner in managing Berkshire, and he repeatedly nursed me back to my mental health when my old habits surfaced,” Buffett said. “Until his death, he continued in that role, and together, along with those who invested with us early on, we ended up in a much better position than Charlie and I ever dreamed of.”

The Omaha-based group — owner of everything from Geico insurance to BNSF Railway to Dairy Queen ice cream — recently set back-to-back record highs, trading more than $620,000 in Class A shares and boasting a market cap of more than $900 billion. .

“Berkshire has become a great company,” Buffett said. “Although I have been in charge of the construction crew for a long time, Charlie should forever be credited with being the architect.”