For the best quality training plus some understanding, most students is moving to another country to follow the advanced schooling. Aspirants are going for student education loans to fund the overseas degree.

Analysis overseas aspirants is take advantage of 2 kinds of knowledge financing we.age., Secure Degree fund and you will Unsecured Education financing. A secured Education loan will bring many gurus when compared to this out of an Unsecured Education loan. Yet not, you will find a familiar myth one of aspirants which they usually do not hope a property mortgage assets while the equity shelter having a guaranteed training loan. But this is simply not possible. Like a secured asset shall be bound given that guarantee security getting choosing a guaranteed overseas student loan .

Within this blog blog post, we’ll clear off all of your current second thoughts and you will impression on the choosing an education financing toward possessions which is already mortgaged underneath the financial.

A familiar myth on the Mortgage Possessions:

Our company is so it’s noisy and you may clear one to a property financing property which is currently mortgaged lower than home financing is approved so you’re able to avail an international student loan. Aspirants can use during the each other individual and you can nationalized finance companies to help you get shielded education loan toward a home loan possessions.

Because of the decreased details about various clauses of knowledge financing, aspirants are not aware they can get a degree financing to your home financing possessions. And that, it divert to own unsecured education loan and you can find yourself using an effective higher rate of interest into the bank.

What things to feel noted when you are securing an education mortgage on the a home loan Possessions:

Regardless of if students is also get covered education loan to your a property loan property, there have been two products one to play a primary character in giving the education mortgage on the financial company. Let us look for, just what those people try:

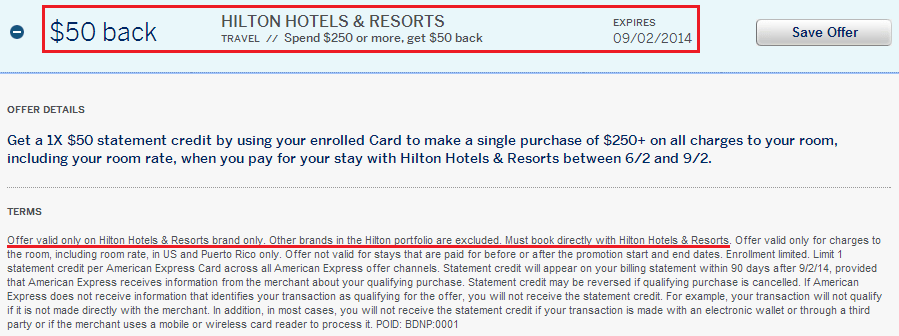

Locate understanding towards the education loan on the a mortgage property, listed below are some circumstances training. Manage discover carefully:

Circumstances Training:

![]()

1. In the event the possessions market value is about 1 crore, such instance the debtor may take right up some money such as for instance mortgage, business mortgage, relationships financing, student loan and private loan from the mortgaged assets till the restrict is not more than.

2. Should your market price of the home is about fifty lakhs and also the financial availed try forty lakhs. However, when the moms and dads has paid 31 lakhs of mortgage so far and you can the fresh an excellent number are 10 lakhs. In such things, brand new scholar is approved to own an extension regarding a loan on the same property.

step three. In the event your market value of the house is 1 crore, the bank tend to sanction 75% we.elizabeth. 75 lakhs of your own loan amount up against the assets. As an example, a borrower has already availed a home loan out of 40 lakhs to your stated property, he/she is however entitled to get the mortgage off thirty five lakhs on the same mortgaged assets. Instance instances was known as extensions off fund. There is no need to accomplish the latest valuation declaration and appear declaration since it is valid for two decades and 3 months, respectively.

cuatro. People is also avail secure education loan on a single mortgaged possessions if in case their/their own aunt has availed a knowledge mortgage having overseas training, offered there needs to be the available choices of harmony matter into mortgaged possessions as of big date.

5. If there’s an ongoing mortgage of the mothers inside the a public markets lender if in case the youngster would like to get an education mortgage getting their/their unique overseas studies together with chosen college or university falls under the financial institution out of Baroda Primary listing, he/ she’ll qualify to locate 100% financing. Secondly, according to the charge standards, all nations inquire about pre-charge disbursement from university fees fees and you can cost of living. And this, move new ongoing home loan tend to complete both the requirements.

six. All the personal business banking institutions reject pre-charge disbursement out of a studies financing. In such cases, if a debtor has recently availed a mortgage and also a great harmony of about dos-step three lakhs, it is strongly recommended to expend the brand new outstanding matter. When this is carried out, new debtor must need a zero Objection Certification (NOC), loan account report saying NIL balance, and you can launch the original mortgaged title-deed.

7. If there is a continuous financial in virtually any societal field or private field bank therefore the scholar https://paydayloancolorado.net/crawford/ is actually prepared to avail off a training loan from the same. It is best to see most of the relevant circumstances instance quantum out-of finance, interest rate, loan margin, tenure, control charge, etc. If the financial satisfies the fresh new requirements of your scholar depending on the price opportunity, next students need to go for it if you don’t he/she will be able to decide for yet another bank. Such as, the cost project for the beginner was 47 lakhs, therefore the credit limit of one’s lender is twenty five lakhs. In cases like this, the new scholar need to remember considering a separate bank.

And therefore, it is always advisable to take financial help and you will guidance regarding the education loan benefits. Elan Financing is here now for the save. Know the way we could make it easier to.

Just how ELAN Financing will assist you to?

ELAN Financing have hitched with 10 creditors, in addition to bodies financial institutions, individual banks and internationally loan providers that make it more straightforward to avail an offshore education loan regarding financial.

Being the partner business, ELAN Money keeps done power accomplish as much go after-ups as required and also to physically connect to the bank managers to automate the loan software processes.

And this, we possibly may highly recommend you earn in contact with our very own fiscal experts at ELAN Money and be assured. We shall have the complete to another country education process done for your as you can start planning for the new while it began with a foreign home.