This article is the on-site version of our Crypto Finance Newsletter. Premium subscribers can sign up here to get the newsletter delivered every week. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Hello and welcome to the FT Cryptofinance Newsletter.

Ripple Labs said Thursday it would launch a stablecoin, and within hours bitcoin emerged from its slumber, rising as much as 4.5 percent. The reaction underscored that, more often than not, it's not the weight of US ETFs that drives the price of Bitcoin.

Since the arrival of Bitcoin ETFs in the US in January, a widely accepted narrative has emerged attributing the cryptocurrency's 57 percent price rise this year to widespread buying by investors such as BlackRock and Fidelity.

The argument goes like this: $12 billion of inflows were chasing a rare asset that will become even rarer after the quadrennial “halving” event in the bitcoin system this month, when the rewards for miners for verifying a block will halve to 3,125 bitcoins. There are about 6,300 tokens issued weekly by Bitcoin, but ETFs bought about 50,000 tokens in that period. QED.

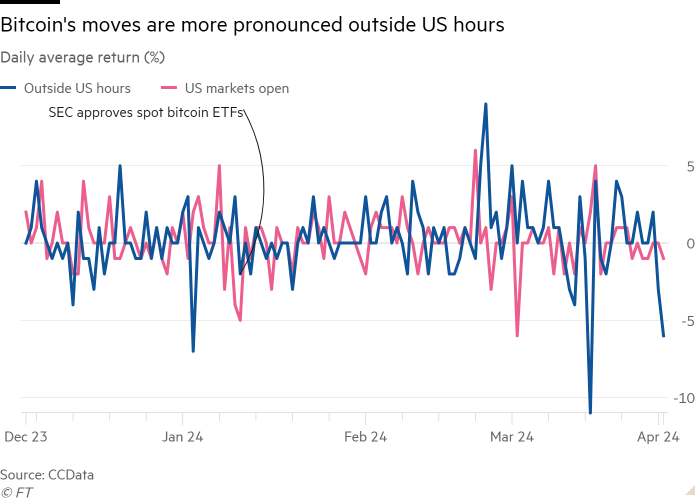

But this broad brushstroke and helpful explanation hide a more nuanced picture. The reality is that Bitcoin activity generally occurs outside of US trading hours.

Since the SEC approved ETFs, the average daily return for Bitcoin outside trading hours in the US has been 0.31 percent. This rises compared to 0.13 percent in the six and a half hours that the US stock market is open, according to CCData.

CCData said the average cumulative daily returns during Wall Street's close were 26.4 percent, compared to 9.9 percent during US trading hours.

Markets also tend to be more volatile when the US stalls. CCD Data found that average 30-day rolling annual volatility during non-US trading hours is just over 40 percent, compared to an average of 36 percent in US trading hours.

This week has been a textbook example of this pattern.

On Tuesday, the price of Bitcoin dropped significantly due to lack of news during Asian market hours. The price continued to fall as the global trading day progressed and Bitcoin was down 7.2 percent at the open of US markets.

Many media outlets reported that there was some intense liquidation of positions on cryptocurrency exchanges, as traders who bet on the price rising and not having sufficient funds in their accounts were removed from the market. Data from Coinglass showed that up to $457 million of positions were liquidated within a 24-hour period. But this is most likely a symptom, not the cause, of price movements.

One theory is that Asia is often the starting point for declines because it is the first region to see the previous day's inflows from US ETFs. Algorithms collect websites to get the latest data and then automatically buy and sell Bitcoin. This theory doesn't really hold water. If algorithms determined the price of Bitcoin based on historical flows, the price movement would be more predictable than it is in reality.

What's more, it doesn't seem like a particularly smart trading strategy. Buying or dumping en masse is a great signal for the market. Other traders can use their own algorithms to quickly figure out where and when automated trading will occur and trigger it in advance. It has been a feature of electronic trading for decades. Anyone who flops into the market with the dexterity of a drunken sailor will not stay in profit for long.

There is more evidence that US ETF providers are not the only price movers, or the most active players in the market. The largest trading volumes in the Bitcoin market are Bitcoin versus Tether, the world's largest stablecoin. This week, Tether, the operator, minted another $2 billion in USDD — as its coin is known — bringing its trading volume to $106 billion.

However, Tether is also an important player in its own right. Last year, it made plans to diversify its reserves away from US Treasuries, by spending up to 15 percent of its net operating profits to buy bitcoin.

According to The Block, Tether bought about $627 million worth of bitcoin in the first quarter, meaning it has about 75,354 bitcoins stored away and is now the seventh-largest holder of bitcoin, up from 11th place.

The influence of the United States is most evident in the weight of trade it brings. CCData found that average daily trading volume is about $1.04 billion during the US stock market's open hours, compared to $1.11 billion during the much longer period when it is closed.

“It suggests that although the market remains globally active throughout the day, trading activity intensifies significantly during business hours in the United States, likely due to the established patterns of traditional financial markets and the role of ETFs,” Joshua De Vos said. Immediate impact on total volumes. Research Lead at CCData.

However, the relative thinness of the US outside-hours market, its greater volatility and tendency for greater returns also opens up another possibility: that Bitcoin's price is more influenced by small investors and high-speed traders who profit from market volatility, rather than its direction. .

BlackRock and Fidelity's success in attracting billions of dollars may depend largely on a small army of day traders and a group of quantitative analysts.

What do you think? Email me at philip.stafford@ft.com

Join me and my colleagues at the Financial Times' Leading Cryptocurrencies and Digital Assets Summit from May 8-9 in London. Hear from some of the industry's leading players including Julia Huggett, CEO of the London Stock Exchange; Bim Afolami, Economic Secretary, Ministry of Treasury and City Minister; Michael Sonnenshein, CEO of Grayscale Investments, and many others. Secure your seat now at crypto.live.ft.com

Weekly highlights

It was the second anniversary of British Prime Minister Rishi Sunak's stated ambition to make Britain a global cryptocurrency hub. My colleague Nico Asghari looked at how things worked.

Ripple, the cryptocurrency conglomerate accused of selling unregistered securities, is set to launch a stablecoin later this year. As of now, it has not been named, and it will compete with Tether's USDT and Circle's USDC. The market seems to be lacking inspiration for names, so what are the chances that it will be called USDR?

This week's audio clip: Doctor, heal yourself

While Ripple Labs was launching its stablecoin, the company was still battling the Securities and Exchange Commission over its hostile stance toward cryptocurrencies. Stuart Alderotti, its chief legal officer, took issue with some of the interpretations of the law offered by the SEC, saying it ignored rulings in Ripple's recent legal case against the agency. He wrote on X:

“If this agency honestly wants to repair the institutional damage it has done (to itself and to the industry) over the past several years in this misguided war on cryptocurrencies, it needs to get off its soapbox and acknowledge these facts.”

Data extraction: Helter Skelter

Despite all the talk of a new world ushered in by the arrival of Bitcoin ETFs in the US, some things haven't changed. Cryptocurrencies are a 24-hour global market, and most trading of the underlying assets takes place on regulated or lightly unregulated exchanges. As CCData shows, the biggest gains and declines occur outside business hours in the United States.

Cryptofinance is edited by Tommy Stubbington. To view previous issues of the bulletin, click here.

Your comments are welcome.