Elon Musk, CEO of Tesla and SpaceX.

Kirsty Wigglesworth | Reuters

TeslaShares fell on Tuesday after the company reported a decline in first-quarter vehicle deliveries, the first annual decline since 2020, when the global pandemic disrupted production.

Here are the key numbers:

Total deliveries in Q1 2024: 386,810

Total production in the first quarter of 2024: 433,371

Vehicle production was down about 1.7% from the previous year and 12.5% sequentially for Tesla, which is not as much as the 8.5% annual decline in deliveries.

Tesla does not break down sales by model, but reported that it produced 412,376 Model 3/Y vehicles and delivered 369,783 vehicles. It produced 20,995 of its other models and delivered 17,027.

In the same period last year, the electric car maker announced the delivery of 422,875 vehicles and the production of 440,808 vehicles. In the fourth quarter of 2023, Tesla announced the delivery of 484,507 vehicles and the production of 494,989 vehicles.

Deliveries are the closest rough estimate of sales reported by Tesla but were not precisely defined in the company's shareholder communications.

Tesla's deliveries for the quarter fell well below even more bearish analyst expectations.

According to an average of 11 estimates compiled by FactSet, analysts were expecting deliveries of about 457,000 for the period ending March 31. Estimates ranged from a high of 511,000 deliveries to a low of 414,000 in the first quarter, with estimates updated in March ranging from 414,000 to 469,000 births.

Troy Teslick, an independent auto industry researcher whose work is closely followed by Tesla fans, had expected deliveries to reach about 409,000 cars.

Martin Vicha, Tesla's head of investor relations, sent a company-compiled consensus based on estimates from 30 analysts over the weekend to pick investors. The consensus, seen by CNBC, said analysts were expecting a median of 443,027 deliveries and a median of 431,125 deliveries for the quarter.

Tesla faced many challenges in the first quarter.

Houthi militia attacks on shipping companies in the Red Sea disrupted supplies of Tesla components and temporarily suspended production at its German factory outside Berlin in January. In March, environmental activists set fire to infrastructure near the same factory, depriving Tesla of sufficient operating power and again causing production to temporarily halt.

“The decrease in volumes is due in part to the early stage of the updated Model 3 production ramp at our Fremont factory,” Tesla said in a statement. [California] Closing factories and factories.”

In China, Tesla has faced an onslaught of competition from local electric car makers, including BYD and new entrants such as phone maker Xiaomi. After sales numbers for its China-made cars slowed in January and February, Tesla reduced production of its Model 3 and Model Y at its Shanghai factory and cut workers' schedules to five days a week from 6 1/2 days.

In the US, reviews have been mixed for Tesla's latest model – a pickup truck dubbed the Cybertruck – which the electric car maker only began selling in small numbers in December last year.

It appears that the series of discounts and incentives were less effective in increasing sales volume than in the past for Tesla.

During the final days of the first quarter, Tesla CEO Elon Musk tasked all sales and service employees with installing and demonstrating the latest version of the company's premium driver assistance system to customers in North America before their vehicles are delivered. The system is marketed as full self-driving but it does not make Tesla cars autonomous. It requires a human at the wheel, ready to steer or brake at any time.

Potential Tesla customers in the United States formed a shrinking group in the first quarter of 2024, according to a report by Reuters citing survey data from Caliber. The report attributed the decline in part to Musk's personality.

Musk continued to bet that Tesla customers and shareholders would stick with the brand and the company regardless of his policies and inflammatory rhetoric on his and her X's.

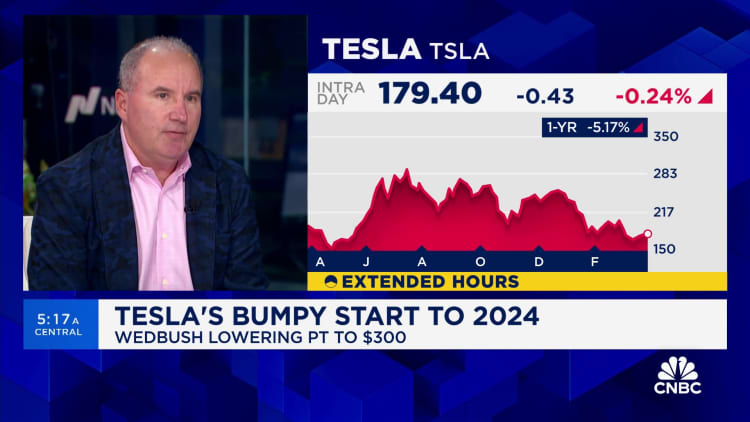

Tesla shares fell 29% in the first quarter, the largest decline since the end of 2022 and the third-largest quarterly decline since the company's initial public offering in 2010. The stock was down about 4.4% to $167.55 as of Tuesday afternoon.

The company has scheduled an earnings call on April 23 to discuss quarterly results.