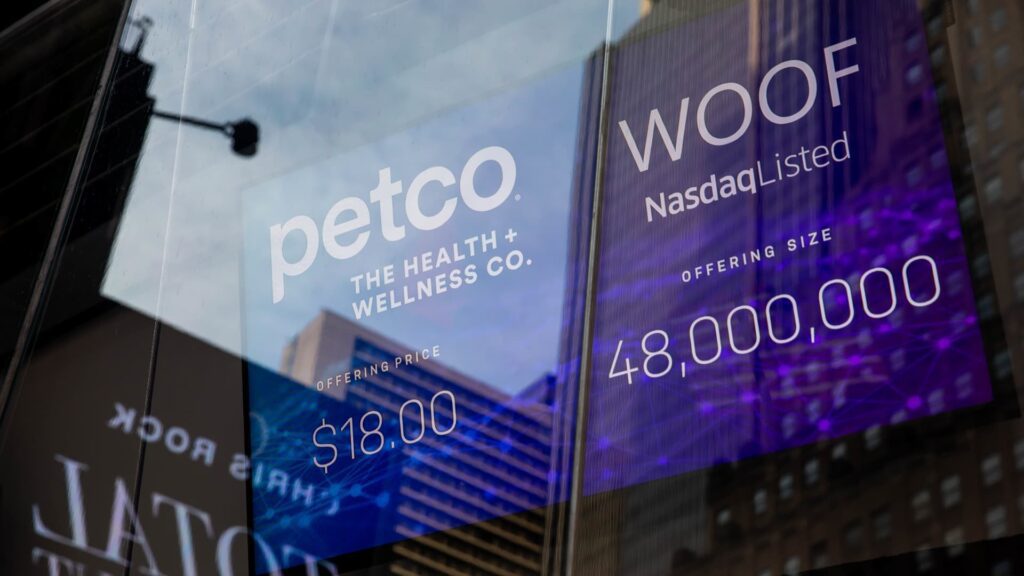

Check out the companies making headlines in midday trading. Cryptocurrency Stocks – Stocks whose performance is tied to the price of Bitcoin rose as the cryptocurrency rose to another record high for the third day in a row. Cryptocurrency exchange Coinbase lost 1.7% and bitcoin proxy MicroStrategy rose nearly 10.9%. In the cryptocurrency mining sector, Marathon Digital lost 2.4%, while Riot Platforms added nearly 1%. CleanSpark gained about 3.8%. Texas Roadhouse – The restaurant chain added 2.6% on the upgrade, beating Bird. The company said the Kentucky-based chain should be able to continue to climb, even as it sits near all-time highs. Moelis & Co. – Shares rose 3.7% after Goldman Sachs upgraded the investment bank to neutral from sell and said it was a “big beneficiary as the cyclical rally begins,” after falling after earnings. Tesla – Stock fell 4.5% after Wells Fargo downgraded the electric car maker to below equal weight, citing “risks to volume as price cuts have a diminishing impact.” Nvidia, Advanced Micro Devices, Micron Technology – Shares of chipmakers fell on Wednesday as the AI-related rally continued to fade this week. Nvidia shares fell 1.1%. Micron stock fell 3.4% and AMD stock lost 3.9%. Dollar Tree – Shares of the discount retailer fell 14.2% after a disappointing quarterly report. Dollar Tree reported adjusted earnings of $2.55 per share on revenue of $8.64 billion for the fourth quarter. Analysts surveyed by LSEG, formerly known as Refinitiv, expected $2.65 per share on revenue of $8.67 billion. The company also announced that it has identified 970 of its Family Dollar locations for possible closure. Dollar General – The discount retailer fell 1.9% after worse-than-expected quarterly results for rival Dollar Tree. Dollar General is scheduled to report earnings on Thursday before the open. It's up more than 14% this year. GE HealthCare – Shares fell 3.6% after the medtech company announced a secondary offering of 13 million shares. GE HealthCare Technologies was spun off from General Electric in early 2023. Legend Biotech – Shares added 4.4% after Raymond James initiated coverage of the biotech company in the trade-stage with an outperform rating. The company is bullish on Legend Biotech's Carvykti treatment, which treats multiple myeloma. Royal Caribbean, Carnival – Shares of both cruise line operators rose after Goldman Sachs initiated coverage on the shares at buy ratings, saying it sees pricing strength and pent-up demand for cruise stocks. Royal Caribbean shares rose 1.8%, while Carnival's stock price jumped 2.9%. Petco Health and Wellness – Shares fell 1.6% after the battered pet retailer announced a search for a new CEO. The company reported fourth-quarter revenue on Wednesday, reporting adjusted earnings per share of 2 cents on revenue of $1.67 billion. Analysts had expected earnings of 2 cents per share on revenue of $1.62 billion, per LSEG. – CNBC's Alex Haring, Brian Evans, Samantha Subin, Yun Li, Lisa Kailay Han, Piya Singh and Michelle Fox contributed reporting.