Skills key economic terms is important having first-day homeowners (and someone else preparing to borrow funds out of a loan provider). Knowing what these types of conditions indicate and you may exactly what a loan provider could be trying to find makes it possible to in all aspects of economic lives, whether you’re to invest in a house, to invest in a motor vehicle, combining obligations, or simply just trying to learn more and more your financial better-becoming.

When you express demand for Twin Metropolitan areas Habitat’s homeownership program, you may be inquired about your income, loans, credit history, and you will financial obligation-to-income ratio. Lower than we’ll define this type of terminology and you will express info and you can instances to help you support you in finding, identify, assess, and you will learn these types of very important rates.

Think about, this short article applies to the fresh Dual Towns Habitat https://simplycashadvance.net/loans/installment-loan-consolidation/ to have Mankind Homeownership System. Everything on this page can vary a little out-of just how almost every other relationships, lenders, and you may software identify, assess, otherwise make use of these wide variety.

Income

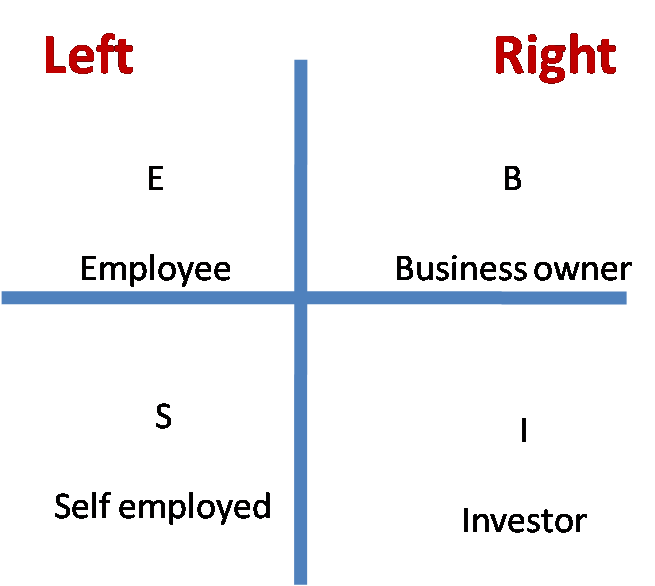

Money is defined as “currency received, specifically several times a day, to possess works or courtesy expenditures otherwise assistance.” There have been two very first form of earnings: Gross income and you may net income.

- Gross income means their overall earnings ahead of deductions including taxes, healthcare, later years discounts, or any other write-offs are built.

- Net income ‘s the money you to remains after those people deductions or expenses was determined.

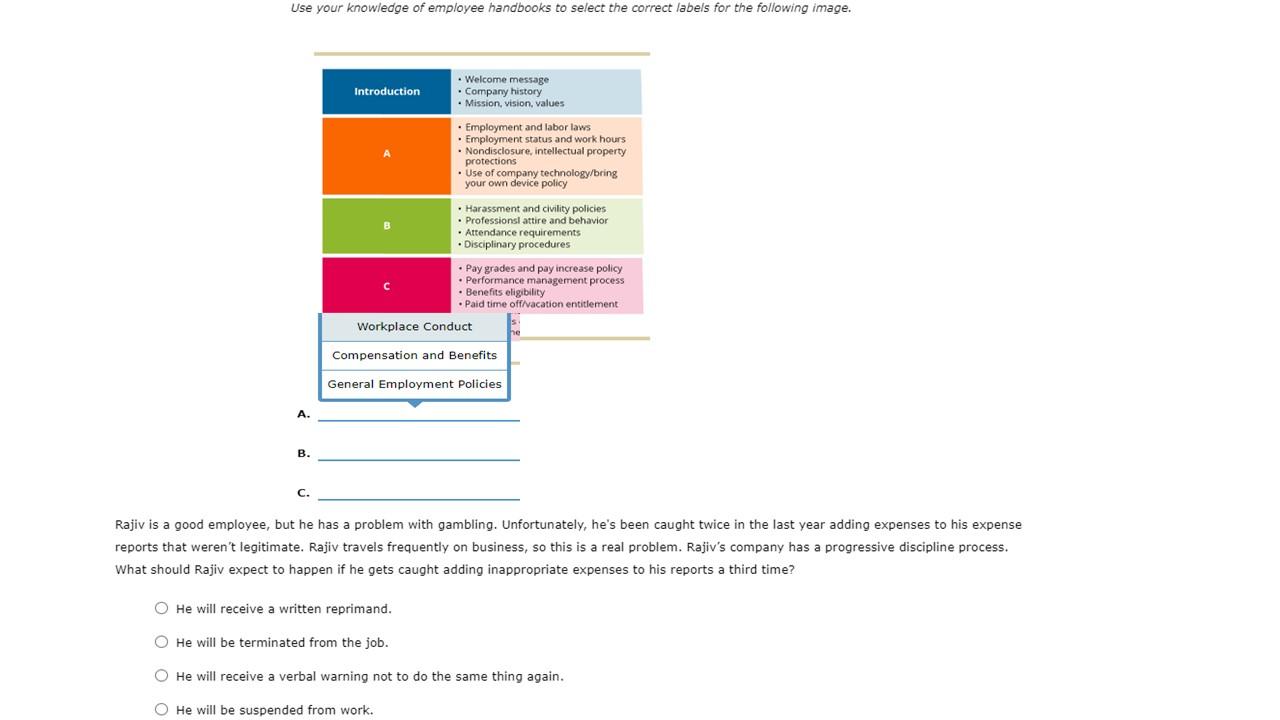

When you find yourself utilized by a business, business, otherwise institution, to help you be eligible for Twin Metropolitan areas Habitat’s Homeownership program, i want to know concerning the revenues to suit your house. While you are thinking-operating, we must think about your net income.

What matters as income?

Money you overview of the fresh qualifications means (and soon after on your software) should include the funds of any people which is traditions at home to you (which is people 18 yrs old otherwise more mature). You should statement earnings off full- and you will region-day operate, self-work, and you may regular or offer functions.

One financial assistance acquired from the a member of your household is also be found in the overall earnings. For example such things as Supplemental Safeguards Income (SSI), Societal Security Disability Insurance rates (SSDI), Personal Security costs, and you can State Advice.

So what does Not number while the earnings?

Do not number money acquired getting dining press or a job income out-of students in age of 18. Money acquired to have proper care of promote college students and you will adoption recommendations is actually in addition to omitted from your income formula.

Provides most other sources of earnings and you may curious about how exactly it could connect with your revenue qualifications? Telephone call our very own Apps Recommendations Cardio at the 612-504-5660.

How can i discover my personal money?

You’ll find your own revenues towards the spend stubs from the workplace. While notice-functioning otherwise work on a contract base, your revenue could be stated towards the a schedule C as an ingredient of your fees.

How to determine my earnings?

Tip: Once you have computed your own disgusting yearly money, need you to matter and divide it because of the twelve. It count is the month-to-month revenues. (ex: $twenty-seven, months = $dos,275 revenues/month) It number is available in handy within the calculating the debt-to-earnings ratio afterwards.

Obligations is defined as bad debts by the one-party (the brand new borrower or “debtor”), so you can an additional group (the lender or “creditor”).

How do i get a hold of this particular article?

Everbody knows what month-to-month mortgage money you will be making. If you are not sure what funds you have got, you might demand a credit history to get into most recent loan recommendations and discover your credit report.

You could potentially request a duplicate of your own credit file by visiting annualcreditreport. (Keep in mind that your credit score is not necessarily the same since your credit rating, which we now have informed me when you look at the a section below.) This really is a free service and a trusting place to rating your credit history. Right here, you could potentially consult a duplicate of one’s credit history from for every of one’s three credit agencies. Different people get request one to free statement (for each 12-week several months) away from for every single agency.