Welcome to FT Asset Management, our weekly newsletter about the movers and shakers behind a global multi-trillion dollar industry. This article is the on-site version of the newsletter. Subscribers can sign up here to have it delivered every Monday. Explore all our newsletters here.

Do the format, content, and tone work for you? Let me know: harriet.agnew@ft.com

Former rugby lawyer is shaking up the world of private credit

Paul Whitman is no stranger to high-profile corporate scraps. The 62-year-old Australian, whose audacious poaching of more than 20 senior executives from asset management firm Barings last month sparked a lawsuit, has spent 20 years running a property company that has been involved in its fair share of takeover battles.

But, as Robert Smith and Will Loach explore in this profile, it was his early career as an Australian rugby league lawyer that provided the blueprint for the Barings raid, which gave Whitman a full team of private credit experts for his fledgling investment business. Corinthia Global Management.

In the 1990s, he helped poach disaffected sports stars as part of the “Super League War” that upended Australian rugby league when Rupert Murdoch bankrolled a new breakaway competition.

In an interview with the Financial Times, Whitman pointed to “similarities” between the sales pitch then used and Corinthia's success in luring an entire team of senior executives from Barings, which is owned by MassMutual, one of America's largest life insurance companies.

“They are obviously two different industries, but if you want to hire people for a new platform, it helps to have a team that is excited about a bold new opportunity,” he said. “It's a similar roadmap.”

Evidence provided by Barings as part of the lawsuit provides insight into Whitman's hiring methods. As early as August 2023 — about eight months before the exodus and a month before he announced the founding of Corinthia — The Australian sent invitations and messages on LinkedIn to key Barings executives who later defected, including the co-chair of Barings' private finance group. , Adam Wheeler.

Whitman said he was not bothered by the fact that his direct approach meant Barings had proof of how to steal their employees. “I thought it was better to talk to people directly rather than through headhunters,” he said. “I'm kind of a front door guy. I think it was effective and I would do it again.”

Private equity stakes are unloaded at a discount as investors seek an exit

Pension funds may be starting to discover that their private equity gold rush has some limitations.

US institutional investors are selling more of their private equity holdings at a discount, as they reduce their exposure to the illiquid asset class, Sun Yu reported in New York.

Led by pension funds and endowments, major investors sold 99 percent of their private equity holdings at or below their net asset value on the secondary market last year, according to Jefferies, the largest number since the investment bank began tracking the figure in 2017. The figures stood at 95 in 100 in 2022 and 73 percent in 2021.

Investors have been forced to increase their use of the secondary market, as stock listings and mergers and acquisitions – traditional ways for private equity investors to exit companies – have become weak recently. Many retirement plans are also having to make payments to their beneficiaries, forcing them to turn to the secondary market to raise money more quickly.

“Public pension funds have for many years pumped money into private equity on the basis that it was high-return, low-risk, when illiquidity was not an issue,” said Richard Ennis, co-founder of EnnisKnupp, a consultancy. Works with retirement plans. “They are now discovering that private equity is not a silver bullet and that liquidity is important for investors with large payout requirements.”

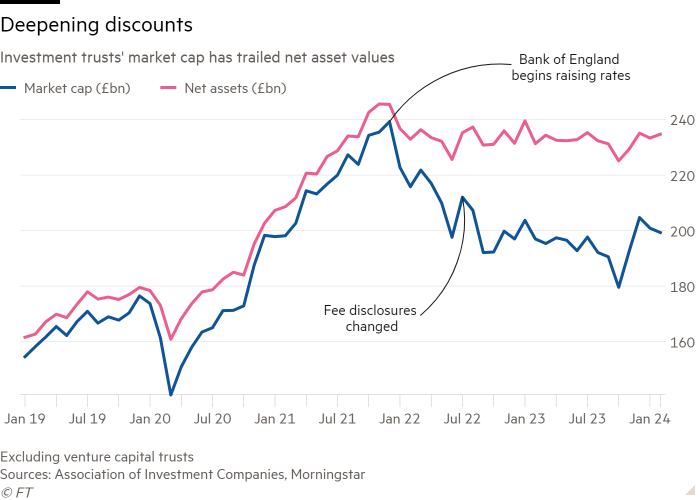

Chart for the week

Investment funds form the cornerstone of UK stock markets, dating back to the Victorian era, when they were created to expand retail investors' access to investments throughout the British Empire (think remote rubber plantations and the like).

Now the UK's £200bn investment credit sector is facing attack on all fronts, as Sally Hickey and Costas Morselas explore in this article. A gap has opened between their stock prices and the value of the assets they hold, they are battling the worst year for capital raising in a decade, and they are being targeted by hedge funds including Paul Singer's Elliott Management and Boaz Weinstein's SABA. capital.

Investment funds make up 27 per cent of companies in the FTSE 350. They include Baillie Gifford's flagship Scottish Mortgage Investment Fund, Bill Ackman's £7.4bn Pershing Square Holdings fund, and RIT Capital Partners' £2.5bn fund.

In recent years, trusts, which operate as closed-end investment funds, have become less popular as higher interest rates lure investors to government bonds. This has pushed the discount rate to 17 percent, its highest level since the financial crisis. The proliferation of alternative instruments that allow easier access to a range of global assets – such as exchange-traded funds – has also hurt the sector.

“Investment funds have been a uniquely British success story and a vital part of the market,” said James D. Bensen, portfolio manager in Janus Henderson Investors' multi-asset team. “That's completely gone.”

Have investment funds reached the end of the road? Email me: harriet.agnew@ft.com

While you were away. . .

Inside Fortnox's unstoppable rise. Tommy Eklund has turned a specialist supplier of accounting software that only operates in Sweden into a stock market celebrity whose share price has risen five-fold on his watch. But analysts are now wondering how much the $4.6 billion niche business can expand – and short sellers are circling the Swedish software group.

Blackstone's flagship real estate fund failed to generate enough cash to cover its dividend last year, putting pressure on a vehicle that the private capital group sees as a beachhead in the retail investor market. Blackstone's $60 billion real estate income fund generated $2.7 billion in cash flow in 2023, mostly in the form of rentals, and paid a distribution of more than $2.8 billion, creating its first annual shortfall in cash from operations to cover payments to shareholders.

The California Public Employees Retirement System has appointed Stephen Gilmore, the former chief investment officer of the NZ$73 billion (US$43.5 billion) New Zealand Superannuation Fund, as chief investment officer, following the surprise departures of two of his predecessors. Gilmore begins work at the largest U.S. public pension plan in July, ending a seven-month vacancy in the top spot at the $494 billion pension fund. The worst job in investing has finally been filled (for now), writes FT Alphaville.

Shareholders don't want Nelson Peltz to recapture the Disney magic. The US entertainment giant defeated a challenge to its board from activist investor Peltz, handing a final victory to CEO Bob Iger and ending one of the most expensive and closely watched boardroom battles in history. Investors, including Vanguard and BlackRock, voted in favor of Disney's 12 nominees “by a significant margin,” in a blow to Peltz's Trian Partners.

The world faces a looming “retirement crisis” that requires rethinking pensions and work patterns, as medical discoveries increase longevity, Larry Fink said in his annual letter. The BlackRock CEO not only drew attention to a long-standing societal problem, but also highlighted a business opportunity that his money manager, and his rivals, including Franklin Templeton, T. Rowe Price, State Street and JPMorgan Chase, hope to grow. Meanwhile, Fink faces a proxy challenge to his dual role as chairman and chief executive of BlackRock from UK activist investor Bluebell Capital Partners.

Goldman Sachs's Bettershell Partners, which holds minority stakes in alternative asset firms, has bought a more than 20 percent stake in credit specialist Kennedy Lewis Private Investment Management from Italian asset manager Azimut, valuing the target at more than $1 billion. Elsewhere, the gender pay gap at Goldman Sachs' UK operations widened in 2023, underscoring how the Wall Street bank has struggled to promote more women into senior roles.

Abrdn shareholders have been urged by influential adviser Glass Lewis to vote against the asset manager's pay report due to the “substantial” base salary of new CFO Jason Windsor. The proxy firm's analysis sets the stage for a potential investor backlash at the FTSE 250 asset manager's annual meeting on April 24, and comes on the heels of a difficult period in which its share price has fallen sharply, knocking it out of the FTSE 100 index twice in recent years.

A group of 3,000 UK private equity dealmakers shared £5bn of carried interest in the 2022 tax year, highlighting the large sums at stake in the debate over how such payments should be taxed. The figure, revealed in a Treasury analysis of Labour's policy, shows the gains made during what has been a lucrative year for the private equity industry, thanks in part to buoyant equity markets.

Hunterbrook Capital has raised $100 million to place trades based on articles published by its newsroom, Hunterbrook Media, and launched a new experiment in funding investigative reporting as the media industry reels from a new round of layoffs. This work is an attempt to bridge the type of investigative journalism typically done by newsrooms and the long and short of hedge funds. The fund places trades based on scoops uncovered by journalists in the newsroom.

Tiger Global, one of the most prolific investors in private technology startups during the venture boom that peaked in 2021, has raised $2.2 billion for its latest venture capital fund, nearly a third of the $6 billion target it touted to investors. When it was first launched. The fund was announced in 2022. Venture capitalists globally are struggling to raise money, signaling the end of the era of “mega funds” and a slowdown in startup deals over the coming years.

And finally

“White magic, black magic,” is how cubist historian John Golding described the twin founders of modernist art, Constantin Brancusi and Pablo Picasso. From beginning to end, white magic sweeps through the Center Pompidou's magnificent, enchanting and awe-inspiring exhibition, writes Jackie Wohlschlager, chief art critic of the Financial Times.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Register here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

Newsletters recommended for you

Due Diligence – The most important news from the world of corporate finance. Register here

Work – Everything you need to get ahead at work, in your inbox every Wednesday. Register here