Product cost and period cost are accounting concepts used to categorize and allocate expenses in a business. These terms play a part in determining the cost of goods sold (COGS) and overall profitability. Product and period costs are incurred define period cost in the production and selling of a product. The one similarity among the period costs listed above is that these costs are incurred whether production has been halted, whether it’s doubled, or whether it’s running at normal speed.

Is Labor a Period Cost or Product Cost?

70% of the offices are for administrative employees, and 30% are for production supervisors. Thus, it is always better to use business logic to identify them by tracing them back to figure out whether they are tied to the manufacturing process of inventories or not. However, if these costs become excessive they can add significantly to total expenses and they should be monitored closely so managers can take action to reduce them when possible. The person creating the production cost calculation, therefore, has to decide whether these costs are already accounted for or if they must be a part of the overall calculation of production costs. Today, we’re breaking down these two concepts to understand their general aspects, relationship with financial statements, and overall impact on business decision-making.

Variable Period Costs

If you’re currently in business, you need a good way to manage costs. Another way to identify period costs is to establish what doesn’t qualify as such. Product costs only become an expense when the products to which they are attached are sold.

Product cost: assessing the true cost of production and setting product prices

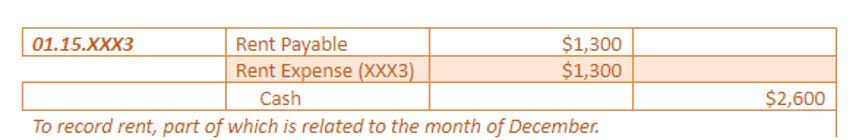

It is important to understand through the accrual method of accounting, that expenses and income should be recognized when incurred, not necessarily when they are paid or cash received. Product costs are all the costs that are related to producing a good or service. These items are directly traceable or assignable to the product being manufactured. Product costs only become an expense when they are sold and become period costss.

Our Team Will Connect You With a Vetted, Trusted Professional

In other words, product costs are the expenses incurred to produce something. Overhead, or the costs to keep the lights on, so to speak, such as utility bills, insurance, and rent, are not directly related to production. However, these costs are still paid every period, and so are booked as period costs. Product costs are often treated as inventory and are referred to as “inventoriable costs” because these costs are used to value the inventory.

Key Differences between Period Costs and Product Costs

The product costs, including direct materials, labor, and overhead, are like the guardians of this treasure. They determine the value assigned to these unsold goods on the balance sheet. These are more like ongoing business expenses, not tied to a particular product but necessary for keeping the lights on. This means they accumulate as the business transforms raw materials into finished products. This timing is crucial for accurately determining the total cost of producing each unit. The period cost is important and a necessary thing to keep track of because it allows you to know your company’s net income for each accounting period.

What are ways to reduce or eliminate period expenses?

- Let’s discuss the accounting treatment of product costs and period costs in greater detail.

- The product costs are the costs incurred by a company directly related to the production of goods.

- Thus, it is always better to use business logic to identify them by tracing them back to figure out whether they are tied to the manufacturing process of inventories or not.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- Managing administrative expenses effectively involves optimizing processes, reducing waste, and ensuring that resources are allocated efficiently to support the organization’s goals and objectives.

- Typically, managerial accountant want to classify expenses in categories that can improve operations.

Accurate measurement of product and period costs helps you report the correct amount of expense in the income statement and assets in the balance sheet. Failing to distinguish between product vs period costs could result in an overstatement or understatement of assets and net income. Let’s discuss the accounting treatment of product costs and period costs in greater detail. The balance sheet is another critical financial statement product costs relate to. It’s a snapshot of a business’s financial health at a specific moment.

The product costs are sometime named as inventoriable costs because they are initially assigned to inventory and expensed only when the inventory is sold and revenue flows into the business. Product costs (direct materials, direct labor and overhead) are not expensed until the item is sold when the product costs are recorded as cost of goods sold. Period costs are selling and administrative expenses, not related to creating a product, that are shown in the income statement in the period in which they are incurred. Other examples of period costs include marketing expenses, rent (not directly tied to a production facility), office depreciation, and indirect labor. Also, interest expense on a company’s debt would be classified as a period cost.

7: Product vs. Period Costs

Common methods of indirect allocation include the use of predetermined overhead rates or activity-based costing (ABC) systems. In this guide, we’ll delve deep into the world of Period Costs, exploring their definition, types, significance in financial analysis, methods of allocation, and strategies for effective management. Whether you’re a business owner, manager, or investor, grasping the concept of Period Costs is essential for making informed decisions, optimizing resources, and ultimately achieving financial success. Also, fixed and variable costs may be calculated differently at different phases in a business’s life cycle or accounting year. Whether the calculation is for forecasting or reporting affects the appropriate methodology as well. Period costs are not incurred during the manufacturing process and cannot be assigned to cost goods manufactured.