Such as, you simply cannot apply for home financing to own a prefabricated family until youre to buy an alternate home. If you currently individual a house, then chances are you should evaluate if or not you could potentially refinance your current financial to your a modular house home loan.

Likewise, you should make certain that the standard family match the minimum requirements necessary for the financial institution. This includes obtaining right quantity of bed rooms and you will bathrooms and you may appointment neighborhood council’s conditions.

In order to be eligible for a standard family home loan, you should be able to prove that you have sufficient earnings to settle the borrowed funds. The degree of income required relies on how much cash you use.

It is critical to keep in mind that the cost of strengthening good modular house is greater than other types of homes since it needs plenty of competent work and you can specialised devices.

Thus, it’s always best to seek advice from home financing adviser or an ago delivering a mortgage to have a standard construction.

An excellent surveyor was someone who works surveys and you can monitors regarding land and buildings. Studies are acclimatized to dictate brand new limits off properties and ensure you to definitely no body otherwise is the owner of any a portion https://paydayloanflorida.net/esto/ of the residential property.

An effective surveyor are expected to examine the website the place you propose to make your prefab house. They go through the fundamentals, wall space, roofing, flooring and you may plumbing system possibilities.

Surveying will set you back are different depending on the size of the house or property and the brand new complexity of one’s job. It is advisable to pose a question to your builder about their surveying costs.

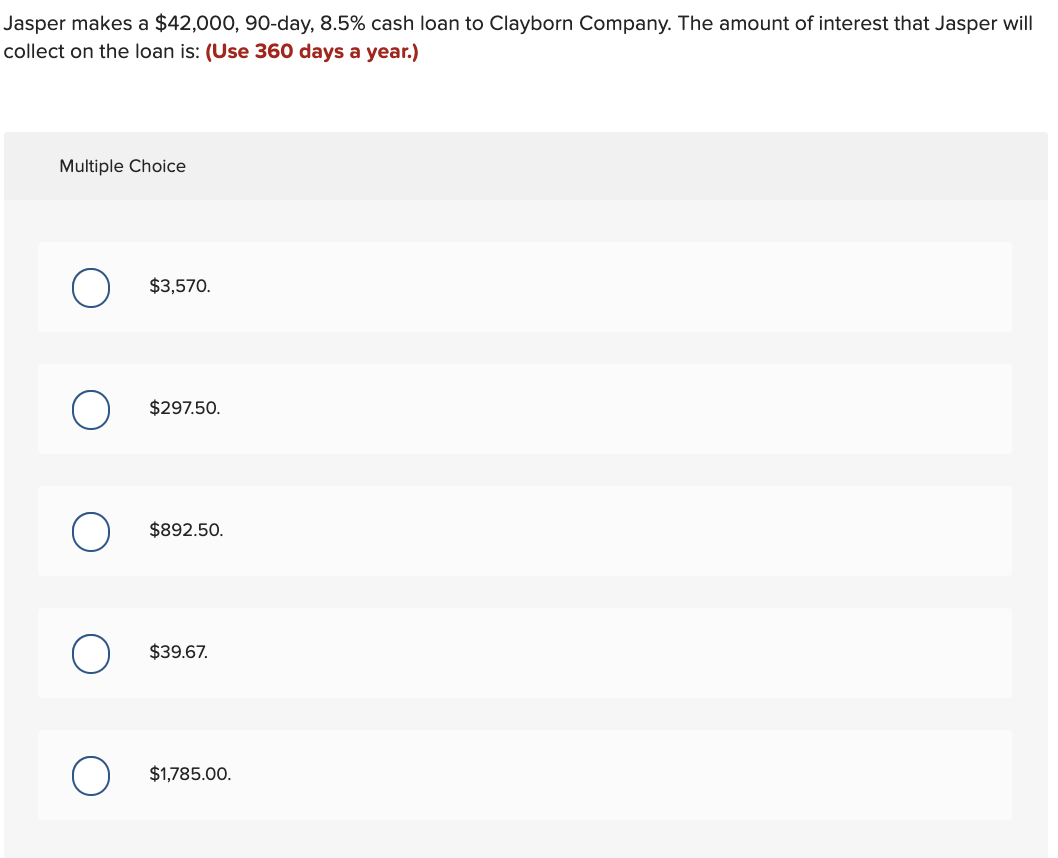

Can you get a mortgage to own a standard house when you look at the Ireland?

Sure, any individual will get a home loan having a modular family when you look at the Ireland however, rules and regulations may vary off their parts of great britain. Standard house build differs from old-fashioned belongings, therefore particular lenders will get think it over an effective riskier investment. Therefore, it will always be better to get in touch with a city large financial company when you look at the Ireland who will help you get a knowledgeable home loan sales.

Ought i get a home loan for the a modular house?

Sure, you can buy a home loan with the modular belongings for those who see all earliest qualification requirements. You just need to give proof of income and property. At the same time, you also need to show which you have enough money in order to repay the borrowed funds.

Modular Belongings are often oriented having fun with metal structures leading them to more durable than conventional brick or wood residential property. Although not, getting home financing into a standard home is quite difficult just like the most banks dont render money throughout these structures.

Whenever you are finding taking home financing towards a standard household, you can contact an expert mortgage broker, who will link you that have modular domestic lenders.

Must i rating home financing toward are formulated land?

Are designed house act like standard land except they are made from pre-fabricated product such as real reduces, bricks and you will timber. Are designed home are often less expensive than modular households as they require faster competent work and you can specialized devices.

Although not, there are certain restrictions in terms of providing a home loan to the are built home. Very financial institutions simply give money having are made belongings if they’re offered once the brand new property. Because of this you cannot make use of the value of the newest are available where you can find safer a mortgage.

You could nevertheless sign up for a mortgage into a manufactured house if you are intending so you’re able to redesign they. If this sounds like the way it is, you should communicate with a specialist mortgage broker who can advise your on the top available options.

What is a non-simple structure home loan?

Sure, anybody can score home financing to possess a modular house offered they qualify set-out by the lender. not, there are specific constraints whenever applying for a mortgage getting an effective modular household.