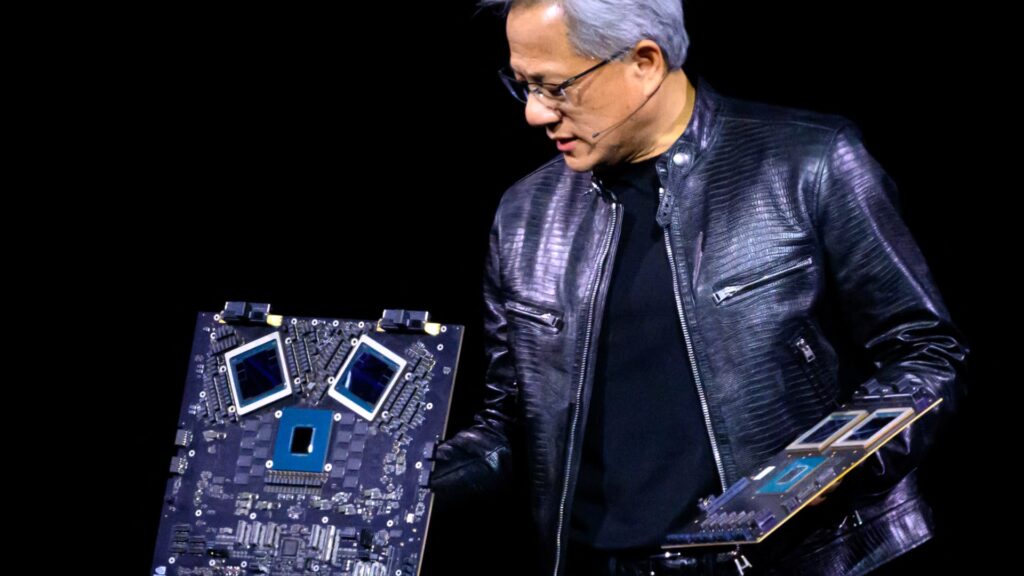

Nvidia founder and CEO Jensen Huang displays products on stage during the annual Nvidia GTC conference at SAP Center in San Jose, California, on March 18, 2024.

Josh Edelson | AFP | Getty Images

Chip industry giant Nvidia It has entered “correction territory,” with its shares now down 10% from its all-time closing high.

The company, which makes graphics processing units – or graphics processing units – has been a major beneficiary of the artificial intelligence boom, which has boosted demand for its chips.

Nvidia GPUs are commonly used for compute-intensive AI applications, such as OpenAI's Chatbot AI. Its server chips are also a key component of data centers.

The company's financial performance has been deteriorating in the past year. It reported a 486% jump in non-GAAP earnings per diluted share in the December quarter, citing huge demand for chips, thanks to the popularity of generative AI models.

But the stock has been under pressure over the past two weeks. Shares are down 10% from their all-time closing high of $950 per share, which they reached on March 25. The stock closed at $853.54 on Tuesday, down 2% during the session.

Nvidia shares fell less than 1% in U.S. premarket trading on Wednesday.

Definitions vary on what constitutes a market correction, but it is generally considered a sustained decline of 10% or more from all-time highs.

What is the reason for the decline?

The exact reason for the downward movement was not immediately clear. Investors could be cashing in on the stock, following massive gains of more than 200% for the stock in the past 12 months. And on Tuesday, the rival chipmaker Intel Corporation It has unveiled a new AI chip called Gaudi 3, aimed at running large language models — the core technology behind generative AI tools like OpenAI's ChatGPT.

Intel said the new chip has more than twice the power efficiency of Nvidia's H100 GPU – the US chip giant's most advanced graphics card – and can run AI models 1.5 times faster than the technology.

Analysts at DA Davidson said in a research note that they expect a “downsizing” of AI models, including alternatives like Mistral's Large model and Meta's LLaMA system, to reduce demand for Nvidia shares over time.

“Although NVDA (Neutral Rating) should deliver impressive performance in 2024 (and perhaps even 2025), we still believe recent trends have led to a significant cyclical pullback by 2026,” DA Davidson analysts said in the note on Tuesday. “.

“The combination of shrinking models, steady growth in demand, mature expansion investments, and increasing reliance by our largest customers on their own chips does not bode well for NVDA's years.”

— CNBC's Ganesh Rao contributed to this report.