Open Editor's Digest for free

Rula Khalaf, editor of the Financial Times, selects her favorite stories in this weekly newsletter.

UK lenders have announced a return to growth in demand for mortgages in the first three months of 2024, according to the latest official data, providing further evidence of a stabilizing property market.

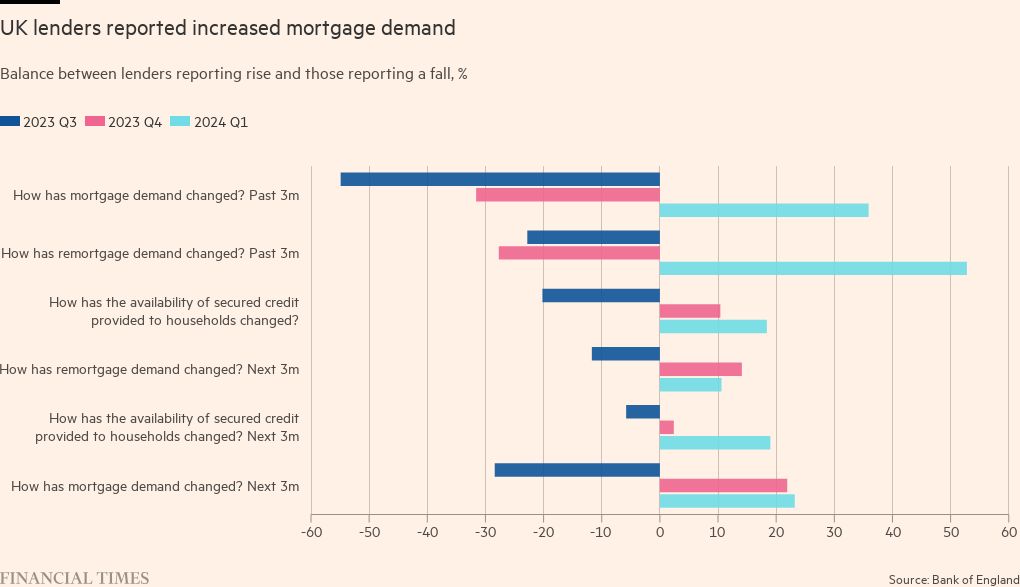

The index, which tracks the proportion of lenders reporting an increase in demand for home loans versus those reporting a decrease, rose to 35.9 in the first quarter, according to the Bank of England's quarterly survey of banks and building societies.

This was only the second time in seven quarters that the gauge was positive as it swung from -31.6 in the last three months of last year. The index has witnessed fluctuations in recent years, with the previous positive reading recorded in the second quarter of 2023.

Likewise, the Bank of England's gauge tracking demand expectations for the next three months rose to 23.2, the highest score in a year, while demand for remortgages was the highest in more than two years.

These results are consistent with the recent recovery in the mortgage market after last year's sluggish performance as lenders reduced borrowing costs from their peak.

Simon Gammon, managing partner at Knight Frank Finance, said: “Demand for mortgages for home purchases has been rising since the new year and the building momentum will continue into the summer.”

He said the housing market recovery “remains on track” although sentiment took a hit at the start of the year after an unexpected increase in December inflation data sent mortgage interest rates higher.

“A lot of people have put off moving while the economic outlook has been so uncertain, but there is a real sense now that buyers want to move on,” he added.

The Bank of England lenders' survey, conducted between late February and mid-March, also found that the availability of secured credit to households improved at the start of the year with the index rising to 18.4 from 10.4 in the last three months of 2023. Lenders also expected availability to improve in the second quarter of 2023. this year.

“Easing credit conditions for secured lending supports the economic recovery, which could lead to stronger growth than the MPC expects,” said Thomas Vieladek, economist at investment firm T. Rowe Price.

But the Bank of England survey found that lenders reported an increase in mortgage defaults and expectations of a further rise in the second quarter. The index tracking expected default over the next three months was 34.2, a slight decline from the previous quarter and the lowest in more than a year.

The continued rise in defaults is “likely a burden from mortgage repayment issues that began during the pandemic and the recent rise in UK mortgage rates,” Weldeck said.

He added that the MPC would not put “much weight on that” and expected defaults to decline in the near term “given the economic recovery, tight labor market and rising real wages.”

There have been some fluctuations in recent real estate market data. Figures released earlier this month from Nationwide and Halifax showed an unexpected drop in house prices in March after mortgage rates rose in January.

This contrasts with recent Bank of England data which showed mortgage approvals rose to a 17-month high in February. Estate agents were also more optimistic about housing demand in March, according to the latest survey by the Royal Institution of Chartered Surveyors.