Just after inside every person’s life, the need to take out a personal loan comes up. This helps while certain that is the best road. It might be best to think twice in advance of choosing an effective unsecured loan price. It could be something which will have an extended-identity impact. One of the consuming questions are, let’s say I do want to send it back? You should know the response to it before generally making you to definitely choice. There are ways you could potentially deal with a personal loan . Keep reading to learn the important points.

Can you return an unsecured loan?

There are not any refunds for personal fund once the money have already been added to your bank account. If you never sign into mortgage, you can right back away when. Refinancing mortgage, yet not, isnt felt a personal bank loan . The newest loan’s due date can be extended to possess a finite date, although this will vary from a single financial to the other. Loan providers is significantly less than no responsibility to include this one.

To see if the bank will bring a sophistication months, you ought to inquire using them. Even if you are unable to escape the mortgage, using it down is obviously a choice. Although not, there clearly was a small catch. Continue reading to know with an illustration.

I lent you ?5,000 at the ten% focus. Fees on your financing reduce the count delivered to your account (?4500). You borrowed the mortgage of ?5000 altogether. The interest into months you retain the bucks is even put into the latest pay. Having fee of your own financing fully, you have to pay the whole count which have attract. It could take out your fund too.

The procedure to expend the non-public mortgage very early

- There are no punishment to own prepaying a loan. There is certainly even more charges if you opt to pay back your loan ahead of agenda.

- Usually investigate mortgage price properly. Every charges and you can interest rates for the the loan should be spelt call at the fresh package.

- A lender could possibly get impose a charge for paying a loan early. After you pay the loan ahead of time, the financial institution needs a fee. The interest you only pay to the a loan is when the financial institution converts a return.

- Once you prepay a personal debt, the financial institution will lose money. When they lose money, they might charge you and then make upwards for it. Absorb the brand new conditions and terms prior to signing people deals. Not all lenders usually charge a fee which rates.

Prepayment punishment

The big company out of unsecured loans generally speaking do not enforce good payment to own very early repayment, but many someone else create. Brand new loan’s rate of interest was calculated according to research by the lender’s standards. He had been loan places Dotsero making a certain make the most of the borrowed funds. Loan providers stand-to generate losses when a loan try paid back very early. Specific loan providers impose a prepayment penalty to pay on losings. There are around three possible a means to make up they:

- A single-day commission

- A portion of the total amount borrowed

- Level of focus missing of the financial because loan are paid off very early.

Just be in a position to to obtain a consumer loan that really works to you personally throughout the of a lot which can be nowadays. A loan is actually categorized because the possibly secure otherwise unsecured according to the brand new security given.

- Signature loans private explore could be the norm. Consequently, they are not capable promote any style out of shelter to possess the loan. You will find increased interest rate since they angle a heightened chance towards the financial.

- Secured personal loans is supported by security. Guarantee try a secured item which is pledged as safety to own financing. To guard on their own regarding default, loan providers tend to require security to-be paid down since the financing standard.

Consequences out of Personal bank loan Default

Defaulting towards the personal bank loan loans is actually a bad suggestion. Individual who non-payments towards a loan has stopped while making necessary costs. Exactly what constitutes a default is defined in another way by individuals lenders.

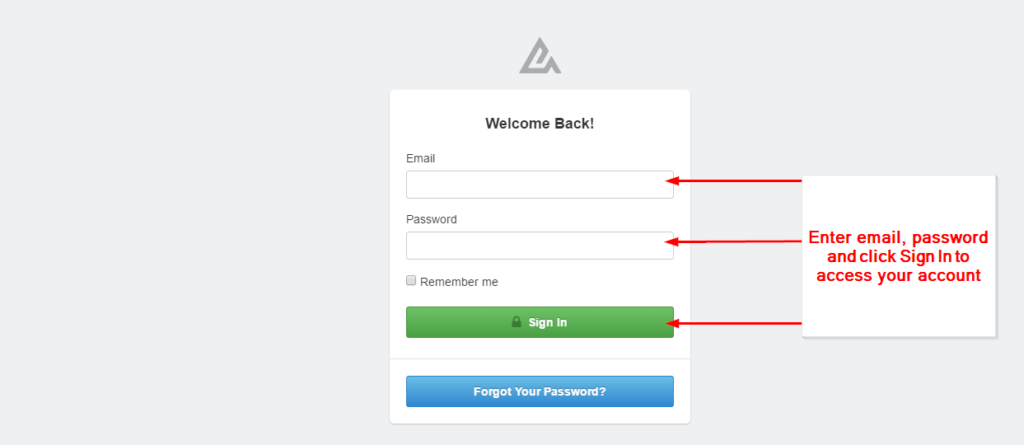

The applying techniques to own a personal loan

Trying to get a consumer loan need paperwork no matter what bank sort of. If you prefer, you may want to accomplish that over the internet. Submitting the application on the web saves effort. Generally speaking, you can find less concerns during these types of apps. For people who fill out the application directly, financing professional may help you in finishing the fresh new app.

Immediately following completing the borrowed funds software, you will need to provide support documentation. Creditors feedback the records you complete, concentrating on particular information. They are attracted to your income. They will certainly seek guarantee that you have a stable supply of money where to settle the borrowed funds. Nevertheless they want to make certain that the income is sufficient to spend straight back the mortgage.

Expected variations having a consumer loan

If or not your apply for a personal loan on line otherwise by way of good antique bank, you will likely have to complete similar papers. Loan providers trust you to fill in the necessary records when it is owed.

End

The greater number of a person’s credit score, the newest wider your selection of offered personal loan items. Individuals with stellar credit scores will get be eligible for signature loans with zero will cost you or penalties to own paying them away from early. This is because you become the sort of borrower who would spend otherwise prepay the loan.

It is best to improve your credit score when it is low so you end up being an extremely prominent debtor. The advantages far provide more benefits than the time and effort required to go all of them. For much more information on commission out-of loan or property foreclosure, check out the Piramal Fund website and then have assured recommendations.