Property guarantee financing normally start the new financial possibilities to have residents. By the experiencing the worth of your home, you have access to financing for renovations, debt consolidating, otherwise big expenditures, most of the while you are experiencing the competitive prices in https://paydayloanalabama.com/twin/ the official.

This short article look into the new particulars of household equity money when you look at the Minnesota, along with the way they performs, the huge benefits they give, therefore the key criteria you should fulfill. Regardless if you are given a timeless home collateral mortgage (HELOAN) otherwise a flexible domestic equity line of credit (HELOC), you will understand tips browse the choices and you can maximize your home’s potential.

Property guarantee loan makes you borrow against brand new collateral of your home, which is the difference between your own house’s worth and you will people a fantastic financial equilibrium. So it mortgage brings a lump sum of money you’ll want to repay more than a fixed term with lay monthly obligations, therefore it is very easy to package your budget.

If you’re questioning how a home guarantee loan functions, think of it as the second mortgage. The quantity you might acquire depends on the residence’s guarantee, credit score, and you may money. Generally, lenders need you to look after at least 10-20% security of your home following financing.

To try to get a home security financing, you’ll need to assemble some financial data, and additionally paystubs, W-2s, and you may tax statements. While you are thinking-working otherwise possess ranged income, look at the financial statement HELOAN. So it family equity loan allows you to qualify having fun with step one-2 yrs from bank comments, simplifying the method and you will providing so much more freedom.

Think about, utilizing your home since equity function you exposure property foreclosure for folks who are not able to build payments. Thus, it’s crucial to think about your finances and you can coming arrangements in advance of investing a property guarantee mortgage inside the Minnesota.

Particular Home Guarantee Loans

There are two version of domestic collateral funds for the Minnesota: the standard home equity financing and the domestic security line of credit (HELOC).

A home security mortgage has the benefit of a lump sum of money with a predetermined rate of interest and you can monthly installments. This type of financing is fantastic for high expenses including household home improvements or debt consolidation. Family guarantee loan costs in Minnesota can vary, so it’s best if you compare also offers.

On the other hand, a property equity line of credit (HELOC) properties more like a charge card. You can borrow as needed, to an appartment maximum, and simply shell out notice on what make use of. HELOCs routinely have varying rates, and that is advantageous in the event the rates are lower but could increase over time.

With regards to a good HELOC versus. a home collateral loan, consider carefully your monetary needs and you can percentage choice. Minnesota domestic security money provide balances, when you are HELOCs bring liberty. It is critical to find the choice you to definitely best suits your financial situation and you may specifications.

Advantages and disadvantages out-of Minnesota Household Guarantee Money

Family guarantee money into the Minnesota is a terrific way to availability financing, but it’s important to weigh advantages and you will disadvantages:

Gurus out of household collateral loans:

- Fixed rates: Many Minnesota home equity funds promote steady costs, and also make budgeting easier.

- Lump sum payment: You get the whole loan amount upfront, that’s ideal for higher expenditures.

- Possible tax masters: Attention may be taxation-deductible in the event that utilized for renovations.

- Short monthly premiums: Compared to large-appeal handmade cards otherwise signature loans, brand new payment per month towards property security mortgage will likely be apparently reduced.

- Manage first mortgage: You have access to their home’s equity while keeping your existing lowest-speed first mortgage undamaged.

Cons out-of household security fund:

- Likelihood of foreclosures: You reside security, thus overlooked payments can lead to property foreclosure.

- Financial obligation raise: You may be incorporating way more debt toward established mortgage, which will be high-risk in the event that home prices drop-off.

- Large rates of interest: Household security mortgage costs into the Minnesota usually are more than those individuals for an initial traditional mortgage.

Tips Qualify for a house Guarantee Mortgage within the Minnesota

Qualifying having a house equity mortgage inside the Minnesota relates to conference trick requirements. Understanding these may help you prepare while increasing your odds of recognition. Some tips about what you generally have to meet the requirements:

- Loan-to-really worth (LTV) ratio: The fresh new LTV proportion is determined from the isolating extent you owe by your home’s appraised worthy of. As an example, whether your financial harmony is $120,000 as well as your house is appraised from the $160,000, your LTV proportion would be 75%. Loan providers typically prefer an enthusiastic LTV proportion of 80% or down to reduce exposure.

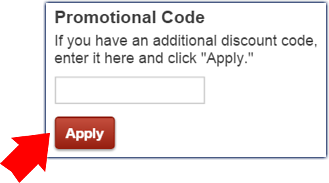

Getting a smoother app process, consider using the Griffin Gold app. It assists you having budgeting and you can financing, which makes it easier to handle the money you owe inside app procedure.

Get a house Security Mortgage in Minnesota

Making an application for a home equity financing during the Minnesota should be an excellent wise monetary move, regardless if you are trying finance renovations, combine financial obligation, or availability more cash. By the experiencing your own residence’s equity, you could potentially safe that loan that have competitive prices. To begin with, make certain you meet the secret requirements, particularly that have adequate home security, a good credit score, and you will a manageable loans-to-income ratio.

To apply for a house security financing for the Minnesota, consider using Griffin Financial support. Griffin Financing commonly show you from the app process, assisting you to maximize your family guarantee. Do the first rung on the ladder right now to unlock your own house’s monetary potential.