Federal Set aside Economic Policy

The fresh Government Set-aside is the central lender of the You. The brand new Given oversees the country’s financial system, guaranteeing they stays secure. Therefore, it is responsible for reaching limit work and you will keeping secure prices.

The fresh financial rules pursued by Federal Put aside Bank is one of the biggest circumstances influencing both the benefit essentially and you may interest levels especially, and additionally financial prices.

The latest Federal Set aside doesn’t set particular rates about mortgage market. Yet not, their measures during the starting the latest Fed Loans price and you may adjusting this new currency likewise have upward otherwise downwards has actually a critical influence on new interest levels offered to the fresh credit social. Grows regarding money supply fundamentally lay downwards tension to your prices if you are firming the money also have pushes rates upward.

The connection Markets

Finance companies and capital firms business financial-supported bonds (MBSs) as capital things. Brand new production offered by such personal debt securities need to be sufficiently high to attract people.

Part of that it picture is the fact that government and you may business bonds give contending long-label fixed-income assets. The cash you can generate in these contending resource items has an effect on the brand new efficiency the latest MBSs offer. The entire standing of the huge thread industry ultimately affects exactly how far lenders charge to possess mortgage loans. Loan providers must generate sufficient output for MBSs to make them aggressive about full financial obligation coverage sector.

You loans with bad credit in Sheridan to definitely commonly used regulators thread standard that mortgage lenders often peg their attention rates ‘s the ten-12 months Treasury bond give. Typically, MBS manufacturers need certainly to bring large yields as the repayment is not 100% guaranteed because it’s which have bodies securities.

Housing marketplace Conditions

Trends and you will requirements regarding housing marketplace along with affect home loan pricing. When less residential property are now being based or considering to own resale, the brand new decline in house purchasing leads to a fall in the interest in mortgage loans and you will forces rates of interest downward.

A current trend who has got together with used downward pressure in order to prices try a growing number of customers opting to help you rent rather than pick a home. Such as for example alterations in the available choices of house and user request affect the amount where mortgage lenders set financing rates.

Home loan Prices of the Financial

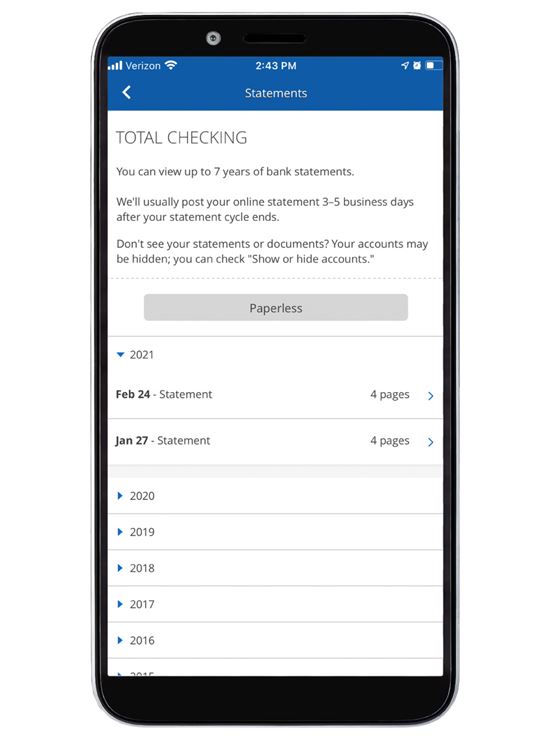

The desk below features average mortgage prices to possess earliest-date homeowners into the 31-12 months fixed, 15-12 months repaired, and you may 7-year/6-week changeable price mortgage for many of your own significant financial institutions because of . Understand that costs are different centered on place and you will credit score.

Mortgage issues try a switch area of the closing process. Specific lenders enables you to spend issues together with your closing costs in return for a lowered interest. So it fundamentally will give you an economy and you can cuts down the home loan payment. One-point generally speaking represents 1% of the total mortgage, so one point with the an effective $200,000 financial would-be $dos,000. The degree of an individual section relies on the kind of mortgage and will become as high as 0.25%.

What’s the Difference in a traditional and you can FHA Financial?

Conventional mortgages are offered of the individual loan providers and so are maybe not supported of the regulators. They truly are compliant, which means it meet requirements put because of the Federal national mortgage association and you will Freddie Mac, otherwise they may be nonconforming, that go above certain loan limitations. Old-fashioned financing generally come with high qualifying requirements, such as for instance large credit restrictions and you can down money.

FHA finance, in addition, try covered by Federal Property Management and you may approved because of the an enthusiastic approved bank. Consequently these funds was supported by the federal government. The newest official certification are often faster stringent than just traditional fund, and therefore individuals with down fico scores also can qualify. You may want to be considered having a lower down payment.