Are you currently wish to obtain your ideal home inside India? Well, we understand you to definitely to shop for a house is no brief feat, especially when it comes to arranging funds. This is when mortgage brokers need to be considered an important device to own turning your own homeownership fantasies towards truth. But hold off! Early planning to brand new comprehensive posts and you can picturing your following colony, it is crucial to understand you to crucial factor: mortgage eligibility. Don’t worry; we now have the back!

Within comprehensive guide specifically geared to home buyers within the Asia, we will walk you through all you need to discover evaluating your own qualification having a home loan. So, let us go on that it enlightening travels together and you may discover the door to reasonable financial support solutions that may build owning a bit of heaven convenient than before!

Put money into your next! Believe our very own educated group regarding real estate agents in order to generate wise investment and build your money.

What’s Home loan?

A home loan was that loan drawn because of the a single regarding a lender to purchase a property. The home would be a house, apartment house, industrial otherwise domestic. The borrowed funds count is actually disbursed at once that is paid back over the years as a consequence of EMIs. Positives become tax write-offs, versatile fees tenure, an such like.

Mortgage Eligibility Requirements during the Asia

After you apply for a home loan during the India, the very first thing lenders will take a look at will be your qualification. Qualifications criteria vary from bank so you can bank, but there are some popular affairs that loan providers thought.

Lenders think about the kind of possessions you are to find, the cost capabilities, while the aim of the loan when evaluating the eligibility.

Sorts of Lenders Available

1. House Pick Funds: These types of fund are acclimatized to finance the purchase from an alternative household. Qualifications criteria of these fund include income, employment history, credit history, and you can down payment count.

dos. Household Structure Loans: This type of finance are acclimatized to fund the construction from another family. Qualification standards of these funds include income, employment history, credit rating, advance payment count, and the land-value on what your house would be depending.

step three. Home improvement Money: These types of funds are widely used to money fixes otherwise home improvements to an enthusiastic existing domestic. Qualification conditions for these loans tend to be products instance income, a career records, credit history, and you may collateral yourself.

4. Family Guarantee Financing: This type of funds are acclimatized to tap into the latest guarantee having become built up for the property. Eligibility criteria for those financing is products such credit rating and you can guarantee at your home.

5. Financial Refinance Financing: This type of money are used to refinance a current https://paydayloanalabama.com/notasulga/ real estate loan at a reduced interest. Qualification requirements for these money were facts for example credit score, a career history, and you will guarantee yourself.

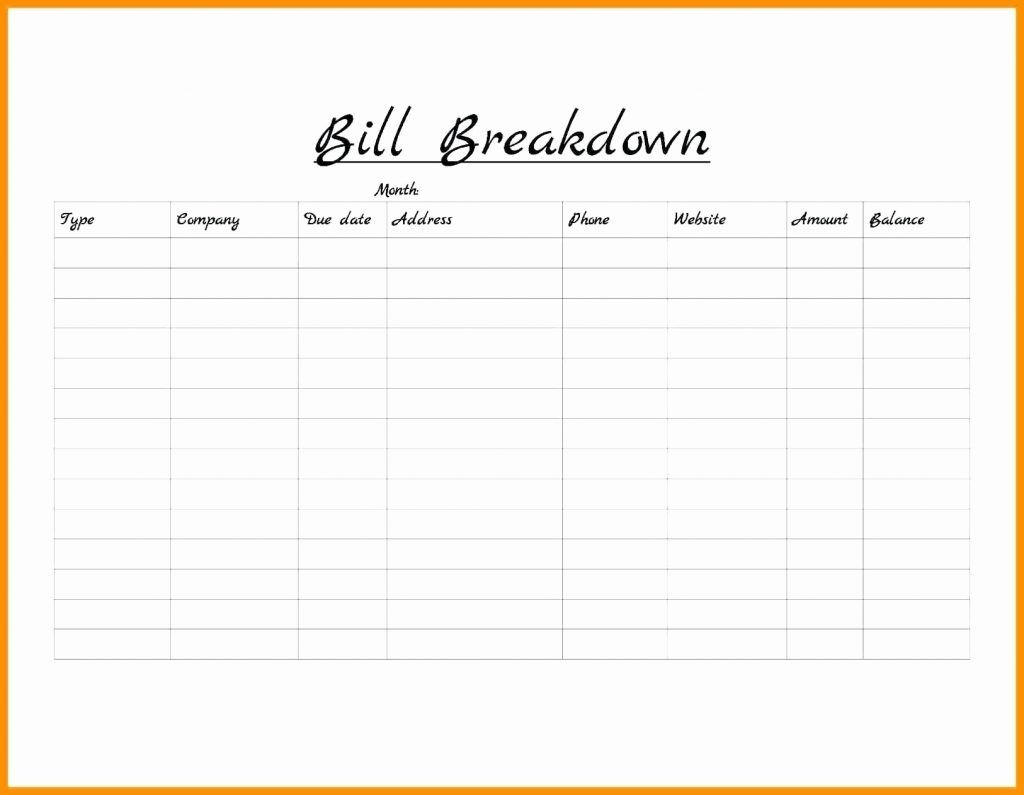

Data Wanted to Make an application for a mortgage

Just take a-deep diving on information on the quintessential documents necessary for home financing app from the learning your site lower than:

Benefits of Delivering a mortgage

step 1. You can buy a diminished interest: Home loans constantly come with straight down rates than signature loans otherwise credit cards. It means you can save money on the entire cost of the loan.

dos. You can buy a longer installment several months: Mortgage brokers will often have lengthened fees symptoms than other sorts of finance, so you can dispersed the cost of the loan more than a longer time. This will make it easier to afford the monthly payments.

3. You are able to your residence equity to help you borrow funds: When you yourself have equity of your property, you can use it once the collateral for a financial loan. As a result you might borrow cash contrary to the value of your residence, which can be of good use if you wish to build a large buy otherwise consolidate obligations.