The venture capital firms that long ran GGV Capital, the 24-year-old cross-border firm that helped serve as a bridge between the United States and China, have settled on two new brands nearly six months after announcing it would split its U.S. operations. And Asia.

Veteran investors Jenny Lee and Jixun Foo have renamed their Singapore operation as Granite Asia, as first reported by Forbes. Meanwhile, Hans Tung, the company's co-founder who lives in the Bay Area, announced on X yesterday that the US team is now called Notable Capital.

GGV Capital announced last fall that it would split its team amid rising tensions between the U.S. and China, though it never cited the atmosphere as the clear driver of the move.

Likewise, Sequoia Capital split its operations last year as it dealt with geopolitical tensions. In the case of Sequoia, the American team retained the well-known brand, while… Sequoia India & Southeast Asia was rebranded as Peak XV Partners, and Sequoia China was rebranded as HongShan, the Mandarin word for redwood.

The thought of ditching the GGV Capital brand, according to a source familiar with the matter, was that since both teams would operate separately in the future, they felt it was better to develop new brands.

Granite Asia is led by Singaporeans Jenny Lee and Jackson Fu. Lee is a fixture on Forbes Midas' list of top-performing venture capital firms, with nine IPOs in the past five years, including smartphone giant Xiaomi and software developer Kingsoft WPS, which went public in 2018 and 2019. respectively.

Meanwhile, Foo, previously global managing director of GGV Capital, is credited with deals including electric car maker Xpeng Motors, which went public in 2020; Ride-hailing giant Didi, which is said to be planning a Hong Kong listing this year; And delivery company Grab, whose shares have underperformed since it became publicly traded through a special purpose acquisition vehicle in late 2021. (It was reportedly in talks last month to merge with another beleaguered competitor, GoTo Group.)

Granite Asia will focus on startups in China, Japan, South Asia, Australia and Southeast Asia.

Notable Capital — which says it plans to continue investing in the United States, as well as in Europe and Latin America — is led by the same investors who have resided in its Menlo Park office for many years. This includes Tung, a Taiwanese-American whose deals include well-known brands such as Airbnb, StockX and Slack; Jeff Richards, who has backed Coinbase, Bluetooth tracking company Tile, and software development company Handshake; And Glenn Solomon. Its deals include HashiCorp, whose software helps companies operate in the cloud (it is said to be currently considering a sale); Publicly traded home buying platform Opendoor; And start Drata compliance automation.

Oren Yunger, GGV Capital's newest member, also remains on the Notable team. Younger joined GGV as an investor in 2018 and was promoted to managing director last fall.

Eric Xu, another long-time managing director at GGV Capital, based in Shanghai, will continue to oversee the parent company's independently operated yuan-denominated funds.

Nearly two and a half years ago, GGV Capital announced it had raised $2.5 billion for its new funds, representing its largest family of funds ever. The investors have since split those assets under management, along with the capital raised previously, so that Granite Asia now has a total of US$5 billion under management, leaving Notable Capital with approximately US$4.2 billion based on GGV Capital's assets under management. For management at the time the division took place. Announce.

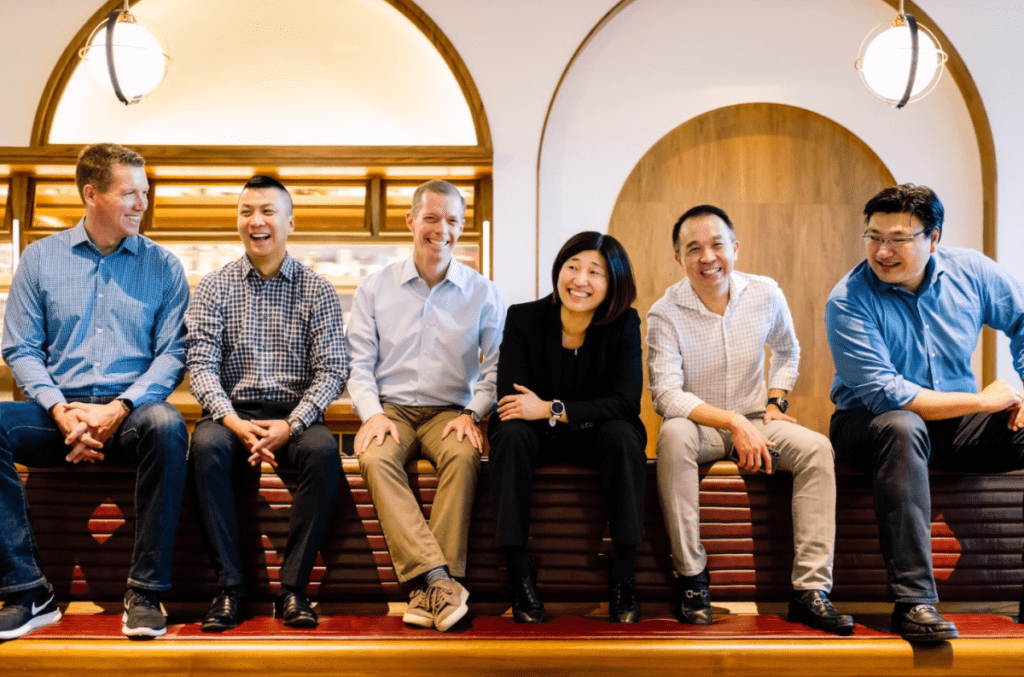

Pictured above, from left to right: Jeff Richards, Eric Xu, Glenn Solomon, Jenny Li, Jackson Fu, and Hans Tong