Are you building a post figure domestic or ree building? Otherwise will you be a specialist with an individual who wants to create an article body type strengthening however, must safer funding? Whatever the your role is actually, securing a housing mortgage to own article body type property or property are vital to bringing installment loans online Maryland assembling your shed alive.

Article frame build was an ever more popular building method using poles or posts to support an excellent building’s roof and you may wallspared to help you conventional stick-situated build, post frame build is much more cost-active and smaller to construct, therefore it is a greatest option for a variety of formations, including land, garages, barns, plus.

But not, just like any construction project, blog post body type construction normally wanted a life threatening financing of your energy and you will money. This is how article physique structure funds are located in. These formal funds are designed to give funding to own article physique build plans, layer anything from materials and labor to help you it allows and you will monitors.

During the Hitch, we concentrate on protecting framework money to possess blog post physique land and you will buildings. We know exclusive means regarding post physical stature build methods and you may manage a system out-of loan providers to add our very own readers having the finest funding possibilities. Whether you’re a homeowner or a specialist, we could help you safe capital to $100,000, even though you has crappy or average borrowing.

One of the largest benefits associated with protecting a construction financing for blog post body type homes otherwise property owing to Hitch is actually all of our lowest prices. I work tirelessly to add the subscribers with many of low rates in the market, making it easier so they can over the projects promptly and on finances.

Blog post figure house construction loan

And if you are looking to resolve your current post figure structure otherwise build another one to, let Hitch help you contain the investment need. The trouble-free procedure and you may knowledgeable people allow it to be very easy to have the construction mortgage you want to suit your blog post physique project. E mail us right now to start!

Post figure build is an extremely engineered timber-body type building means that is increasingly popular lately. It framework means even offers numerous gurus, as well as cost, results, reliability, and you will strength. On this page, we shall talk about some great benefits of post figure framework money and exactly how it can help build your building project possible.

One of the biggest benefits associated with article figure structure is its capacity to bring clear covers all the way to 100 legs, making it an ideal choice getting a variety of formations, in addition to homes, garages, barns, and more. In addition, post physical stature structures are really easy to maintain and can feel depending quickly, resulted in all the way down construction costs.

Another advantage out-of article frame framework is actually the freedom. Blog post frame structures should be constructed on numerous fundamentals, leading them to flexible to several climate and you may website conditions. This liberty can make post physical stature build an excellent option for a good many systems.

On Hitch, we create post physique build investment easy. I specialize in securing build loans to have post figure houses, and you may our very own educated class makes it possible to navigate the credit processes constantly. I run a system regarding loan providers to include all of our customers having competitive pricing and versatile funding selection, aside from its credit rating.

And if you’re considering a blog post physique build enterprise, let Hitch help you support the financing you need to build it a reality. Contact us today to discover more about all of our article physique framework investment alternatives and start the building venture from on the right foot.

Financial support The Rod Strengthening Made simple that have Hitch’s Lending Platform

You can fund their rod building, with Hitch’s lending program, the method has never been convenient. Whether you’re trying to find an enthusiastic unsecured consumer loan otherwise must discuss other money choice, Hitch possess your covered. That have nationwide recognized loan providers contending for your needs, you can rest assured your acquiring the best prices and you will conditions offered. Along with, Hitch couples that have rod barn suppliers and you can shops to provide an excellent smooth and you will issues-100 % free experience. Complete a query during the Hitch today and commence investigating their funding selection within seconds.

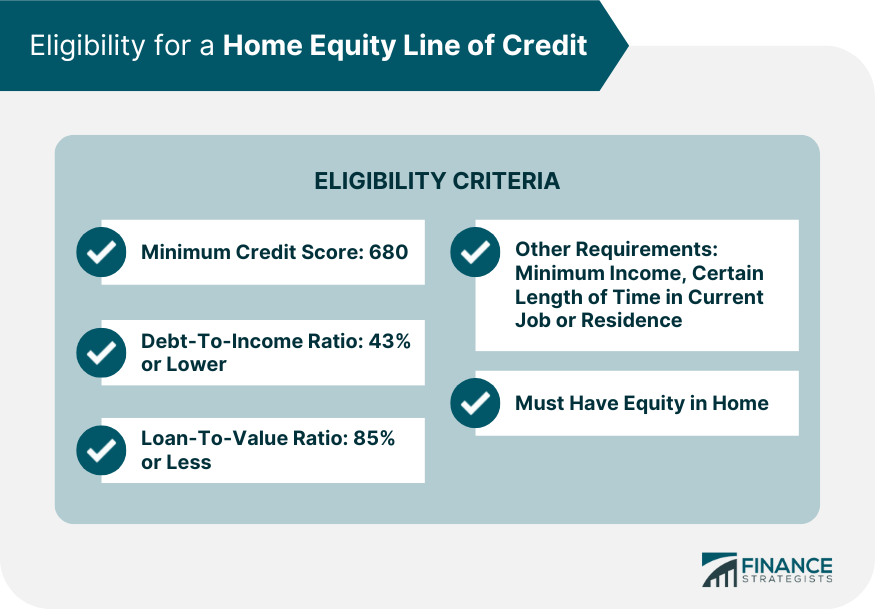

dos. HELOCs features good 10-seasons draw months. From inside the mark several months, brand new borrower is needed to generate monthly minimal repayments, that will equivalent more out of (a) $100; otherwise (b) the complete of the many accrued fund charge or any other costs for the latest monthly asking duration. Inside draw months, the fresh new monthly minimum money may not reduce the an excellent dominating equilibrium. Within the cost period, the fresh new borrower is needed to build monthly minimum repayments, that may equivalent more away from (a) $100; otherwise (b) 1/240th of outstanding harmony at the conclusion of brand new draw period, and every accrued finance fees or other fees, costs, and you may costs. Inside installment months, the new monthly lowest money might not, with the the total amount permitted for legal reasons, completely pay back the principal harmony a fantastic with the HELOC. After the fresh cost several months, this new borrower must pay people left an excellent equilibrium in one single full percentage.

step 3. Committed it takes to find money is measured throughout the big date this new Credit Spouse receives most of the documents questioned throughout the applicant and assumes this new applicant’s said income, assets and title advice considering on the application for the loan matches this new expected documents and you may people help guidance. Extremely borrowers manage to get thier money on average in 21 months. The time period computation to obtain cash is in accordance with the very first 4 months from 2024 mortgage funding’s, assumes money try wired, excludes weekends, and you can excludes the us government-required disclosure waiting several months. Enough time it needs to obtain bucks vary according to the applicant’s particular economic activities additionally the Credit Lover’s most recent number of software. Closing costs may differ of step three.0 – 5.0%. An appraisal may be needed as finished on possessions oftentimes.

cuatro. Not absolutely all consumers will meet what’s needed needed to meet the requirements. Costs and you will terminology is susceptible to changes predicated on markets requirements and you may borrower qualifications. That it offer are susceptible to confirmation away from borrower certification, possessions reviews, income confirmation and you may borrowing recognition. This is simply not an union so you can provide.

5. The message considering is shown to own advice aim just. That isn’t a partnership to provide otherwise offer borrowing. Pointers and you will/otherwise times are at the mercy of change with no warning. All fund is actually at the mercy of borrowing approval. Almost every other limitations will get use.