Who Also provides forty Year Mortgages?

Brand new small answer is Yes. The RefiGuide tend to meets you having loan providers who offer 40 12 months home loans to the people along with particular borrowing from the bank. Normally, the lower the credit score, more equity try to refinance to your a great forty-year home loan otherwise a bigger off-payment if you are searching to order a house having an effective 40-season mortgage.

7 Good reason why forty Year Mortgages Aspire A great.

This particular fact makes it possible to afford a house which is alot more pricey otherwise result in the financial more affordable. If you find yourself you’ll find positives and negatives of good forty-year mortgage, there’s absolutely no concern he is becoming more popular once the domestic philosophy increase.

Listed here are a whole lot more what to discover such money and why they might be a good fit for your needs.

Particular 40-12 months Lenders Bring ten-Season Interest Just

One-way some loan providers render forty-year mortgages is like this: You have to pay 10 years attention only with lower costs, after that 30 years spending dominant and you may attention. This is exactly a means you can have lower money once you are making less of your budget. Up coming, once you’ve got introduces and offers, you might transfer to the eye and you will prominent part of the financial for thirty years.

Specific FHA Loan providers Promote Adjustable Rates 40 Seasons Mortgages

Truth be told there are also FHA lenders that offer varying rates toward 40-season mortgages. You can buy FHA covered mortgages and this can be repaired to possess 5 years immediately after which reset to the a fixed price toward remaining portion of the financing.

Rates of interest towards mortgage loans is actually eventually falling starting in 2024, however they are planning rise in the future since the Provided try gonna boost rates once or twice this year. You can get a reduced, fixed-rate mortgage one can last for 40 years however you will you would like to act in the near future to help you secure reduced cost.

Way more Lenders Providing 40-12 months Mortgages during the 2024

Its even more you are able to now than just a short while ago discover an effective forty-seasons mortgage. While not all the lender now offers all of them yet, they are starting to be more understood because home prices possess risen considerably during the last a couple of years.

Frequently it’s more straightforward to increase a thirty 12 months home loan so you can forty years, when you find yourself having difficulty with the money. Possible expand specific funds to 40 years that try supported by Freddie Mac, Federal national mortgage association, FHA and Virtual assistant.

Even more Home To purchase Stamina with a great 40 12 months Loan

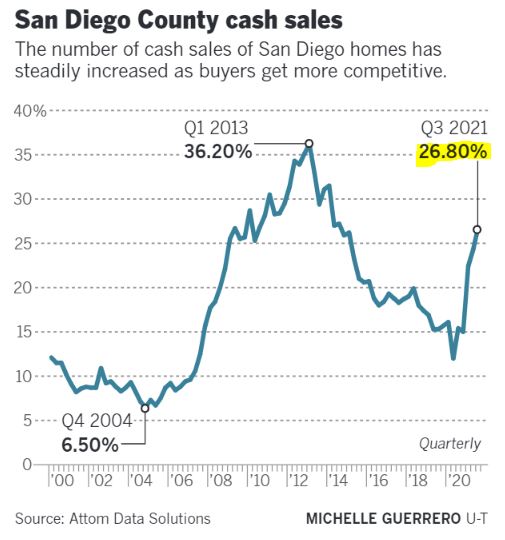

When you have observed, home values have increased 20% or maybe more over the last seasons a number of places around the The united states. This reality causes it to be much harder having huge numbers of people to cover the property.

But with a forty-12 months mortgage, you are able to has down monthly payments and that means you can acquire a house.

Yet another technique for some individuals who possess a lower life expectancy money is to get good 40-year financial with a lowered fee for some many years.

Whenever they expect their earnings usually escalation in three or four many years, they’re able to re-finance the financial to the a good fifteen season or 29-seasons financing. This allows these to benefit from lower money to possess a while you are however improve costs when they make more money.

Keep in mind that whether or not you really have a 30-year otherwise forty-year financial, you’re in a position to pay it back sooner than you envision. People’s financial issues change-over many years.

Even if you take out good forty-seasons loan now, you will be in a position to often re-finance www.elitecashadvance.com/payday-loans-il/cleveland/ they or spend they out of immediately following 20 otherwise 25 years.

Imagine if you understand might purchase your home, ensure that it stays for a few otherwise 3 years, market it and you can disperse in other places. In cases like this, it makes feel to get the lower you’ll payment.