The consumer price index accelerated faster than expected in March, pushing inflation higher and likely dashing hopes that the Federal Reserve could cut interest rates anytime soon.

The Consumer Price Index, a broad measure of the costs of goods and services across the economy, rose 0.4% during the month, bringing the 12-month inflation rate to 3.5%, or 0.3 percentage points higher than in February, the Department of Labor Statistics' Bureau of Labor Statistics reported. the job. Wednesday. Economists surveyed by Dow Jones were looking for a gain of 0.3% and a level of 3.4% on an annual basis.

Excluding the volatile food and energy components, core CPI also accelerated 0.4% month-on-month while rising 3.8% from a year ago, compared to estimates of 0.3% and 3.7%, respectively.

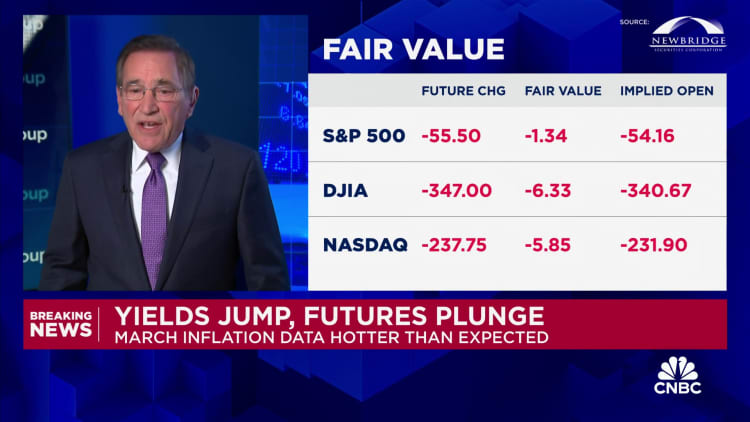

Stocks fell after the report while Treasury yields rose.

Shelter and energy costs led the increase in the index for all items.

Energy rose 1.1% after rising 2.3% in February, while shelter costs, which make up about a third of the weight in the CPI, rose 0.4% month over month and are up 5.7% from a year ago. Expectations that shelter-related costs will slow over the year have been central to the Fed's thesis that inflation will cool enough to allow interest rate cuts.

Food prices rose just 0.1% month-on-month and rose 2.2% year-on-year. However, there have been some big gains within the food category.

The meat, fish, poultry and egg index rose 0.9%, driven by a 4.6% jump in egg prices. Butter fell 5% and cereal and bakery products fell 0.9%. Dining out rose 0.3%.

Elsewhere, used car prices fell 1.1% and medical care prices rose 0.6%.

Rising inflation was also bad news for workers, as average real hourly wages were flat during the month and increased just 0.6% over the past year, according to a separate statement from the Bureau of Labor Statistics.

The report comes with markets on the brink and Fed officials expressing caution about the near-term direction of monetary policy. Central bank policymakers have repeatedly called for patience on interest rate cuts, saying they have not seen enough evidence that inflation is on a strong path back to their 2% annual target. The March report is likely to confirm concerns that inflation is firmer than expected.

Markets had been expecting the Fed to start cutting interest rates in June with three cuts expected in total this year, but that changed dramatically after the release. Traders in the federal funds futures market pushed expectations of the first cut into September, according to calculations by CME Group.

“There's not much you can point to that this will lead to a shift away from hawkishness” by Fed officials, said Liz Ann Saunders, chief investment strategist at Charles Schwab. “June for me is definitely off the table.”

The Fed also expects services inflation to decline over the year, but that has shown it is also stubborn. Excluding energy, the services index rose 0.5% in March and was at an annualized rate of 5.4%, which was contrary to the Fed's target.

“This marks the third strong reading in a row and means the stalled reflationary narrative can no longer be described as a blip,” said Seema Shah, chief global strategist at Principal Asset Management. “Indeed, even if inflation falls next month to a more comfortable reading, there is likely enough caution within the Fed now to mean that the July cut may also be overdone, at which point the US election will begin to interfere with monetary policy.” “. Fed decision making.”

Later on Wednesday, the Federal Reserve will release minutes from its March meeting, providing more information about officials' stance on monetary policy.

Several Fed officials in recent days have expressed doubts about cutting interest rates. Atlanta Fed President Rafael Bostic told CNBC he expects only one cut this year, and it likely won't happen until the fourth quarter. Governor Michelle Bowman said an increase may be necessary if the data doesn't cooperate.