Posts

- What’s the Generational Wealth Gap? – Gametwist casino free money

- Child Bloomers Slot > Comment and you will 100 percent free Enjoy Demonstration

- A lot more Slots Out of Booming Game

- Simple Ways to Create More cash In the Holidays

- How do i view my personal gameplay logs to your Kid Bloomers position game?

That have bonus features such as free revolves, multipliers, and crazy symbols, there are many chances to improve your winnings with every twist. Along with, the online game’s large RTP (Come back to User) rates means that players features a good risk of successful. The cost of life insurance may vary according to a variety out of issues, this research looks into the typical can cost you by decades, identity size, payout numbers, and much more. In the event the youngest of the quiet age bracket reached the 50s in the 1996, their average money is $296,417.

What’s the Generational Wealth Gap? – Gametwist casino free money

The first trick analysis give a concise review of your number away from “Vacations age-trade in the united states” and take your own straight to the brand new relevant statistics. Donations often rise between Thanksgiving and you may Christmas time, and several scammers take advantage of the increased spirit away from generosity within the this time around. Acting in order to solicit contributions for a great basis, fraudsters have a tendency to request contributions by mobile, current email address, text message or even a great crowdsourcing platform. They may give you get into payment details about a false site or give over the telephone. Research-based consultative organization Javelin Function & Research talks of a personality fraud ripoff while the a strategy you to a unlawful spends to deal someone’s personal information for the intended purpose of illegal profit.

Child Bloomers Slot > Comment and you will 100 percent free Enjoy Demonstration

The baby boomer age Gametwist casino free money group is the reason a hefty part of the world’s inhabitants, particularly in install countries. After leasing bookings start rolling inside the, you’ll repay the brand new bounce home very quickly. Up coming, should your industry near you allows, you can purchase much more jump houses to expand your company.

- The new terrible is the fact that the cuteness is pursue me personally irrespective of where I go – for the P.C, smart phone otherwise tablet.We waited for everybody to be on lunch (to quit getting mocked) and you can sat as a result of gamble what appeared as if a family dream game.

- The fresh boss is actually guilty of financing the brand new retirement bundle as well because the going for and you may managing its investments.

- That it age bracket is the largest inside American background for many decades, and it is one of the most important today when it comes to senior way of life.

- Age bracket X used the fresh Boomers, and had been accompanied by Millennials.

A lot more Slots Out of Booming Game

Expanding life span makes it possible that middle-agers often save money time in senior years than just the moms and dads performed. An average endurance is actually 77.five years by 2022 regarding the U.S., step one.step one years more in the 2021. Homeownership will likely be a main origin because the a home beliefs often take pleasure in over the years, that can boost your overall wealth. Old age savings, including 401(k)s and you can IRAs, and enjoy a featuring character, if you’ve constantly provided. Simultaneously, the knowledge and career possibilities can affect your own generating potential, and this impacts yourself money accumulation. Inside gambling games, the fresh ‘family boundary’ is the popular identity representing the working platform’s founded-within the virtue.

Just whenever of several millennials may have in the end started taking the professions and you may profit on the path to gains, the newest COVID-19 pandemic hit. Of many Us citizens is actually referring to layoffs, spend slices, and you can furloughs, leaving the least tenured pros probably the most insecure. “That doesn’t mean one to policymakers are not encouraged making alter to some of these options that will assist. But also for boomers who’re currently approaching senior years they need to not rely on which manna out of paradise, as they say.”

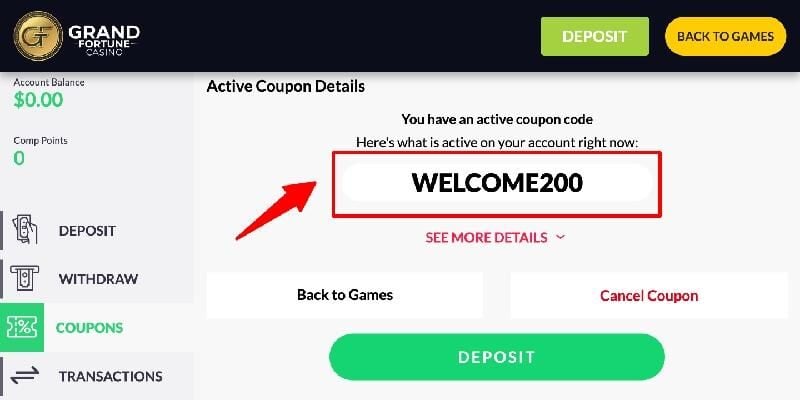

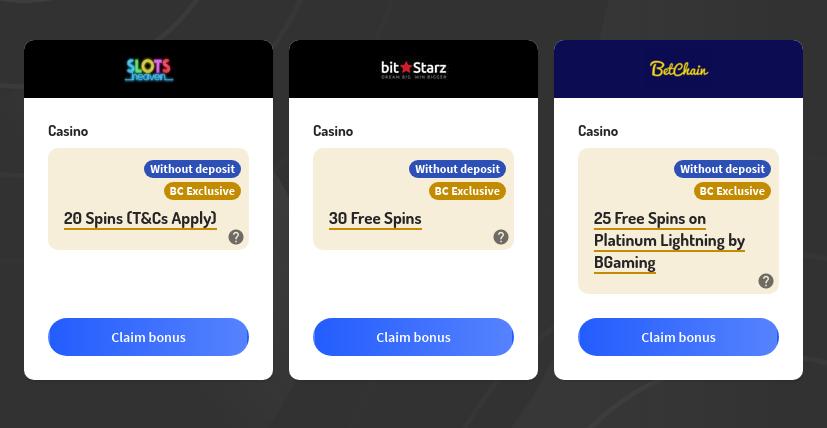

The little one Bloomers position provides a leading RTP price, giving people a fair danger of profitable. Sure, you might play the Baby Bloomers position free of charge to the individuals online casino websites. Action onto the farm in the Infant Bloomers, where adorable critters and you may pastel hues offer a rich undertake the fresh classic slot setup, improving your fool around with warm charm. Before enjoying the invited bonuses, excite meticulously check out the general terms and conditions of any local casino, found at the base of their site web page.Play responsibly; discover our betting help tips.

Seniors’ individual companies are value $7.23 trillion, if you are millennials’ individual companies are really worth only 19% of this at the $step 1.42 trillion. Inside the 2022, the little one boomer age bracket possessed 43.2% of all a house in the You.S. Gen X possessed 33.2%, millennials 13.2% and you can hushed age bracket ten.4%. Inside 2022, almost all of the the nation’s riches (64.6%) belonged to the old years that have middle-agers possessing a massive 52.1% of the country’s money, because the hushed generation owned several.5%. Caroline Blankfort, a real estate agent located in Nashville, worked which have no less than 15 clients previously around three decades whose mothers features provided them money to purchase a property.

Simple Ways to Create More cash In the Holidays

Since the indexed, the new Quiet Age group arrived personally before Kid Boomer generation. That it age bracket, and this spanned from 1928 due to 1945, is considered much more mindful than simply their moms and dads were. That it age group are responsible, even when, to own shaping 20th-100 years pop community, and they produced using them television stories, filmmakers, gonzo reporters, and you will governmental satirists.

How do i view my personal gameplay logs to your Kid Bloomers position game?

Retirees within their late 1960s and you may very early seventies — elderly boomers and other people created while in the The second world war — is actually, while the a group, inside significantly very good condition economically. That is the average later years-account balance certainly households ages 55 so you can 64, according to the NIRS. “The brand new bucks has most already been centered from the highest money profile,” said NIRS Executive Manager Diane Oakley. Based on Fidelity Investments’ oft-cited guidance, someone is always to aim to retire having savings equivalent to eight times its salary.

Blankfort, just who and spent some time working as the a representative within the Ny, said she’s got viewed these types of presents more frequently within the Nashville, where marketplace is getting increasingly competitive because the area develops inside prominence. Millennials are not only as people in the straight down costs, however they are and generally looking at other people to own help than the prior generations. A good 2018 study from financial characteristics team Court & Standard found that 43 percent men and women below thirty five received help away from parents otherwise loved ones when selecting a property. Having a median loans away from $128,100000 and you can income away from $73,000, millennials have a much more difficult time paying off loans and you can building wealth. At the same time, you could potentially note that the fresh median income to have millennials is $3,100 more than the new median income for boomers back into 1989. Did you know that millennials is the least wealthy generation, despite the fact that they already show the greatest group inside the new You.S. staff?

Basically, when rates rise, prices out of fixed-income ties slide. Diversity do not make sure money otherwise ensure up against a loss. Knowledge monetary beliefs and you will choice is very important to develop and you can play customized monetary agreements. Fundamentally, Baby boomers provides cherished hard work, economic versatility and you will charitable giving. There is also popular keeping control of the funds and so are cautious about possible economic uncertainties.

The primary homebuying decades for seniors have been on the middle-1980s for the mid-1990’s, and portrayed a fairly blast to be in the market. Inside the 1985, the new average product sales rate to have property regarding the U.S. was just $84,275, or perhaps the exact carbon copy of around $246,556 today. To purchase a house could have been shown to be a sound funding because the costs flower steadily, gaining to sixty% from the start of your homebuying decades to have boomers for the find yourself. However the top-notch the marketplace once you’re family hunting — not to mention the growth (otherwise use up all your thereof) home based thinking pursuing the a buy — can make a big difference between exactly how homebuying takes on out per age bracket. Few things does a lot more to change total total well being than a flourishing cost savings you to definitely have someone working continuously and you will generating sufficient to go on. Specifically, the earlier you could begin your work, the sooner you’re also building wide range and you may leading to a great 401(k).

They have been mostly funded because of the team by themselves using their paychecks, often with a few form of complimentary share regarding the company. Workers are normally provided the option of investments, such an assortment of mutual money, so it is its duty in order to contribute sufficient money and invest they intelligently. Numerous million seniors have died from the decades since the but immigration for the U.S. provides aided replace the production.