While technology The world is eagerly awaiting Reddit's public debut, and another company you may have never heard of is about to go public: Astera Labs. This could be a more important test of the return of investor appetite for technology IPOs.

Astera announced this week in a public filing that its public debut will be larger than it initially planned in every way: It will sell more shares — 19.8 million versus the previous plan of 17.8 million — and at a higher price, and it expects to sell at a higher price. $32 to $34 per share, versus the previous range of $27 to $30. Astera said it expects to raise $517.6 million in the middle of its high range, up from $392.4 million. IPO watchers expect it to debut this week.

While a Reddit IPO could bring good results from investors looking to buy a well-known social media company that has an interesting and thriving AI data business, Astera Labs is an AI hardware story. No, it's not competing with Nvida, the American chip giant that created the world's most sought-after AI chip.

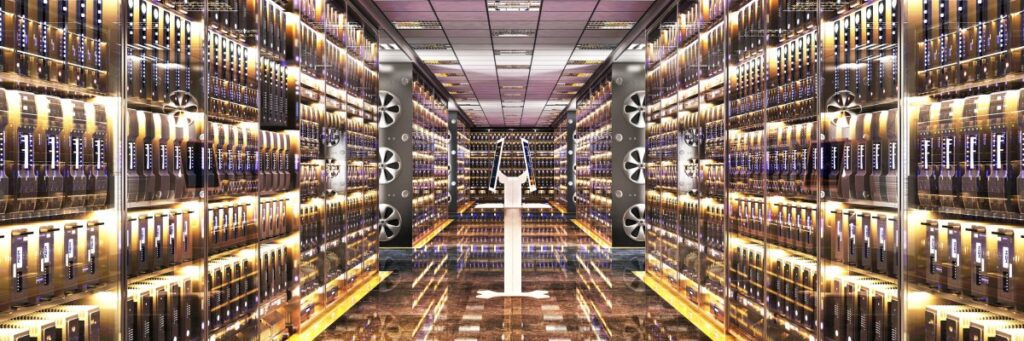

Astera Labs manufactures connectivity devices for cloud computing data centers. As AI requires massive amounts of data moving in, out of, and around data centers, Astera has seen its revenues boom recently. After generating $79.9 million in 2022, revenues swelled 45% in 2023 to $115.8 million.

With 271 references to “artificial intelligence” in its most recent filing with the Securities and Exchange Commission, the company is working hard to convince investors that it is part of the larger AI boom.

How successful Astera will be in AI in the long term is up for debate. Nick Einhorn, vice president of research at Renaissance Capital, a firm that tracks the IPO market and offers ETFs focused on public offerings, seems somewhat skeptical. Astera is “not an AI company,” Ininghorn told TechCrunch. However, the company is “capitalizing on this trend,” in his view, particularly spending on AI-driven data centers. So much so that in 2022, Amazon signed an escrow agreement allowing it to purchase at least 1.5 million shares, which is not proof that Amazon Web Services is a customer, but it hints at it.

Then again, while the company has a story to tell in the AI space, its recent rapid growth and apparent early profitability could be the main drivers of public market investor interest.

Businesses can grow and make money at the same time

In the startup world, growth and losses often go hand in hand. Startups raise capital from private market investors, investing money in their operations to increase headcount so they can build and sell more quickly. Often, by the time a startup reaches the scale required to file for an IPO, it is still unprofitable and is unlikely to start generating adjusted earnings, let alone profit under more stringent accounting standards, in the near future.

Until Q4 2023, Astera Labs appeared to be that kind of company. Its business has grown rapidly in the past year, with huge losses.

In 2022, its revenue was $79.9 million, and it posted a net loss of $58.3 million. In 2023, its revenue was $115.8 million, and its net loss was $26.3 million. So, on an annual basis, this is far from the type of profitable companies that IPO experts say this tough market requires. Even when the company removed the non-cash costs of paying its workers partly in stock, the company's adjusted earnings remained negative in 2023.

But when we dig deeper, her financial success becomes more nuanced. In the third quarter of 2023, Astera Labs' revenues began to grow significantly: from $10.7 million in the second quarter of 2023 to $36.9 million in the third quarter, and $50.5 million in the fourth quarter.

Although this uptick in growth is impressive in itself, the company's profitability picture has also improved radically as 2023 comes to a close. After recording a net loss of $20.0 million in Q2 2023, the net loss evaporated to just $3.1 million in Q3 2023.

In the fourth quarter, Astera Labs generated $14.3 million in net income.

Einhorn warned that the company's results for the fourth quarter of 2023 may not herald a new normal for the company. “One of the challenges with companies like this is that you tend to be very customer focused, and customer purchasing patterns can be very lumpy,” he explained. Good recent quarters don't always mean similar future quarters. Astera revealed another weakness: In 2023, its three largest customers accounted for about 70% of its revenue.

Putting it all together: Astera Labs has been riding waves thanks to AI data center spending. The resulting financial glow has been impressive, and helps explain why its IPO is scheduled to come in at a valuation of about $5.2 billion, a healthy rise from its final private market price of $3.15 billion.

If the company is able to attract a strong following after the first day of trading, it could open the IPO door to other companies that see new growth as a byproduct of artificial intelligence. And that might be enough to sneak more tech offerings this year.