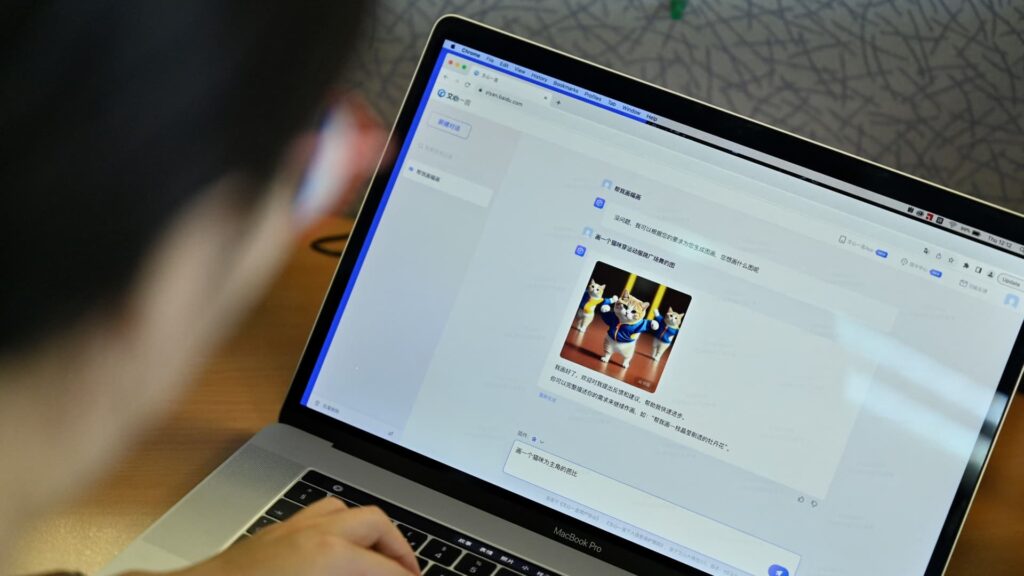

Chinese AI stocks are rising, even if the broader market recovery remains less muted. The unveiling of OpenAI's text-to-video product Sora came at the end of the Lunar New Year holiday in China. Locals were quick to discuss and share the technology's potential online, and when markets reopened on February 19, AI-related stocks soared. Wind Information, China's equivalent of Bloomberg, even launched a Sora Conceptual Stock Index of mainland Chinese stocks that has risen more than 20% in a week. Other wind AI-related indicators have seen similar gains in the past few days. Now next week, tech giant Baidu — which Morgan Stanley calls “China's top AI play on the Internet” — is set to report earnings. The investment analyst team led by Gary Yu has a $140 price target and an overweight rating for Baidu's US-listed shares. This is 25% higher than where Baidu closed on Thursday. Yu pointed out how Baidu has integrated its ChatGPT-like Ernie chatbot with Samsung's new Galaxy S24 smartphones, and has a strategic collaboration with Honor, a smartphone brand spun out of Huawei. “We believe the current cloud AI integration between Galaxy AI and Ernie is just the first step,” Yu said. “Although the scope of current monetization may be limited, we anticipate that there may be further expansion into other phone models, or potential development into a long-term AI model, which is an as-yet untapped market (i.e. data processing and algorithms) directly from the endpoint device without an Internet connection).” On Wednesday before the US market opens, Baidu is set to release results for the final three months of 2023. The company operates a range of technology businesses, including a search engine, cloud services and robot taxis. China's slow-growth macro environment represents a headwind for Baidu's core advertising business, while regulators are keeping a close eye on artificial intelligence. This does not stop companies from experimenting with AI tools. Checks by Benchmark analysts led by Fawne Jiang found that advertisers are increasingly adopting AI-powered advertising tools, thanks in part to their cost-effectiveness. Generative AI ads will likely contribute more than 100 million yuan ($14 million) to Baidu's results in the fourth quarter, Jiang said in a February 21 report. She noted that Baidu had previously indicated that AI advertising revenue was expected to generate more than 1 billion yuan this year. “We are particularly interested in the number of new enterprise customers and the average spending trend of existing customers integrating new services,” Jiang said. Benchmark has a $210 price target on Baidu for the stock and a Buy rating. JPMorgan China Internet analyst Alex Yao has a higher price target of $215. Generative AI advertising is expected to bring in 2 billion yuan in revenue for Baidu this year, for a total AI contribution of more than 9 billion yuan to the company — which has not yet been fully priced, according to a report released earlier this month. . Including support from artificial intelligence, Yao expects Baidu's core advertising revenue to grow 7% this year as the economy recovers. But for the fourth quarter of 2023, it cut the forecast by 2 percentage points to 6% year-on-year growth. Baidu was one of the first bidders for “AI godfather” Geoffrey Hinton and his technology more than a decade ago, according to Kade Metz in his 2021 book Genius Makers: The Mavericks Who Brought AI to Google, Facebook, and the World. While Hinton went to Google instead, Metz describes how Baidu pooled similar talent and built similar research in artificial intelligence. When Baidu launched its Ernie bot in March 2023, the company also showed off its text-to-video capabilities, though it's not clear how widely available it is or how it compares to Sora. Relatively small-cap stocks like Sinodata traded in Shenzhen have jumped on the Sora news bandwagon. The company claims to be a Microsoft solutions partner for data and AI, and through Azure, it can get priority access to Sora's API when it is released. Microsoft did not immediately respond to a request for comment. Synodata shares rose more than 16% in a week despite a letter of concern from the Shenzhen Stock Exchange over whether the company was misleading investors. Despite all the interest in AI stocks, Chinese markets this year are still grappling with concerns about whether Beijing is doing enough to support economic growth. Following the volatile decline in mainland stocks, the country replaced the head of its securities regulator just before the Lunar New Year holiday. That prompted the regulator last week to crack down further on so-called market manipulation. The Shanghai Composite Index rose more than 4% last week to offset 2024 losses, although the S&P 500 is already up more than 6% for the year so far. EPFR data show that as of mid-February, weekly flows into Chinese equity shares were above the recent average. Net inflows into Chinese equity funds are about $45.7 billion so far this year, more than half of the $77.56 billion net inflows for all of 2023, EPFR said. However, US regulations have created risks and opportunities around China-linked AI. Nvidia's latest earnings revealed that its revenue in China fell to a single-digit percentage of its data center business — down from more than 20% months ago. Baidu shares fell last month after reports linked it to the Chinese army's testing of publicly available artificial intelligence systems, and the company said it had no commercial cooperation. Bernstein analysts expect that domestic AI chip players will be able to cover almost all of the domestic demand for advanced semiconductors in the next two years. “We prefer Cambricon as the best alternative to Huawei in China,” the analysts said in a report issued in late January. They have a target price of 160 yuan for Cambricon's Shanghai-listed shares – an increase of 12% from Friday's levels. Huawei shares are not publicly traded. Bernstein analysts have an Outperform rating on Baidu and a price target of $140. They also like Kingsoft Office, which has integrated generative AI into its consumer-facing software. “Kingsoft Office stands out as the player with a product ready for mass launch, but monetization remains to be proven,” Bernstein analysts said. They have a price target of 380 yuan on Shanghai-listed Kingsoft, up more than 50% from Friday's levels.