All of our education loan calculator device helps you know what your monthly student loan money look for example as well as how the finance commonly amortize (be paid out-of) over time. Earliest we determine this new payment for each and every of your respective money actually, considering the loan matter, interest rate, loan label and you may prepayment. Following i seem sensible brand new payment for every single of the fund to determine exactly how much might spend as a whole for every single few days. New amortization of the loans over time try calculated of the deducting extent you are expenses into prominent every month regarding your loan balance. The primary portion of the monthly installments goes right down to $0 towards the end of every financing term.

A great deal more out of SmartAsset

- Determine your earnings taxation

- Compare unsecured loan prices

- Contrast student loan re-finance cost

- Examine offers accounts

- Regarding it address

- Learn more about college loans

- Infographic: Best value Colleges

Student loan Calculator: Just how long Can it personal loans Nebraska bad credit Shot Pay?

It’s no wonders one getting a qualification has expanded more pricey recently. For the majority of youngsters, the only method to stand atop that it rising wave might have been by taking with the an increasing number of student loans.

From the thinking about a student-based loan calculator, you could potentially examine the costs of getting to various universities. Variables just like your relationship reputation, age and exactly how long you’re browsing (more than likely four years if you find yourself entering since a beneficial freshman, couple of years if you’re transferring because the a junior, etc.) enter the formula. Next with a few monetary suggestions such as for instance exactly how much your (otherwise all your family members) should be able to contribute each year and what grants otherwise gift suggestions you currently covered, the fresh new education loan fee calculator will reveal exactly how many obligations you will definitely deal with and you may exactly what your will cost you could well be after you scholar both monthly and over the latest longevity of the fund. Of course how much might pay will also confidence what type of financing you opt to take out.

Education loan Benefits Apps

The government provides various student loan applications, revealed less than, that provide low interest rates and other college student-friendly terms. If you are able to use any of these applications to help you pay for part of the educational costs, your debt just after graduation is generally easier to carry out.

Style of Figuratively speaking

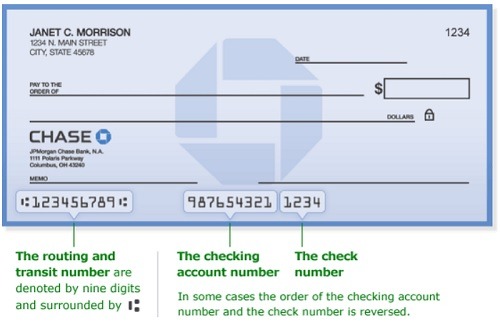

Prior to getting with the different types of offered loan programs, why don’t we create a quick refresher about how exactly just student loans performs. Like any form of loan (auto loan, mastercard, mortgage), student loans prices particular bit to obtain (an enthusiastic origination commission) and so they require appeal and you may prominent money thereafter. Dominant payments wade to your paying back exactly what you’ve lent, and you may attract money consist of certain decided portion of the fresh number you still owe. Generally, for people who skip money, the eye might have had to pay are set in your complete financial obligation.

The federal government support youngsters buy university through providing a good quantity of financing applications with an increase of advantageous terms than simply very private loan possibilities. Federal student education loans is actually novel for the reason that, if you find yourself students, your instalments is actually deferred-that’s, put off up until after. Some types of Government funds are subsidized and don’t gather focus money in this deferment months.

Stafford Financing

Stafford fund would be the government government’s top student loan choice for undergraduates. They give you a decreased origination fee (regarding 1% of the loan), a minimal interest levels you are able to (5.50% on 2023-2024 educational season), and in lieu of automobile financing or any other different financial obligation, the speed will not trust the fresh borrower’s credit score otherwise money. All of the beginner who get an effective Stafford financing pays an equivalent rates.