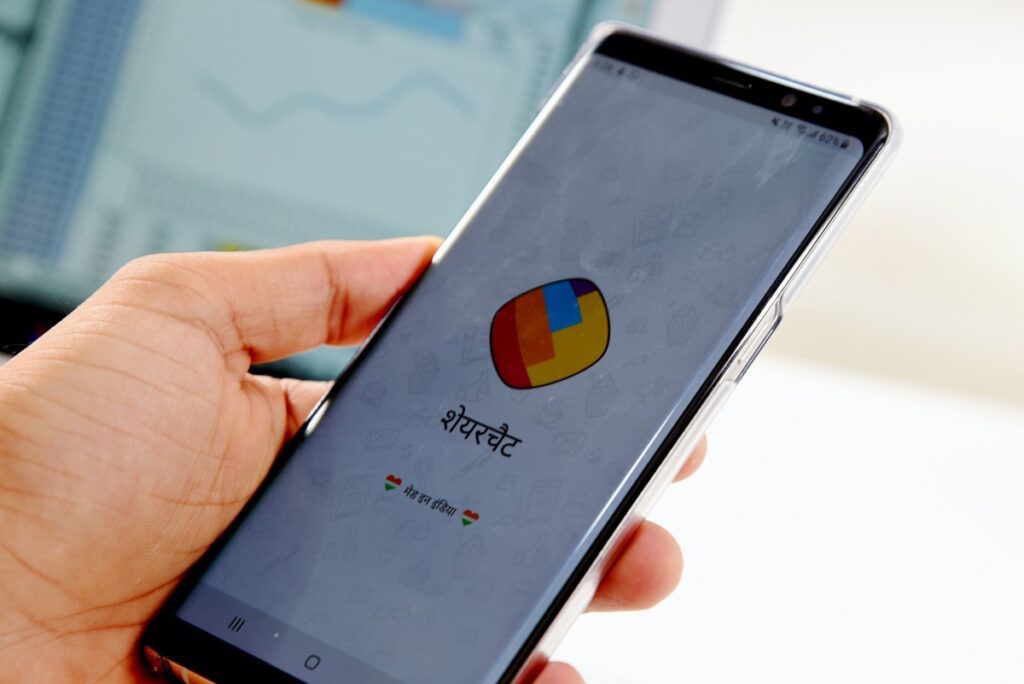

Social media startup ShareChat's valuation has fallen to less than $2 billion from about $5 billion after a new funding round, a source familiar with the situation told TechCrunch, marking a sharp decline for the nine-year-old Indian startup that has more than 400 million users in the world. South Asia market.

The Bengaluru-based startup, which runs a popular social network that supports dozens of Indian languages as well as a short video app, announced on Monday that it has raised $49 million in a convertible round. It did not reveal the valuation at which the money was raised, but it strongly denied that its new valuation was less than $2 billion, stressing that there was no “valuation” associated with the round.

Existing investors, including Lightspeed, Temasek, Alkeon Capital, Moore Strategic Ventures and HarbourVest, invested in the new round, the startup said. Their debt will be converted into equity worth less than $2 billion in the next round, according to a source with direct knowledge of the terms. The source requested anonymity to speak frankly. TechCrunch reported in December that ShareChat was facing a steep valuation decline.

ShareChat also counts Google, X, Snap, Tiger Global and Tencent among its backers. It has raised about $1.75 billion so far. ShareChat was valued at $4.9 billion in a funding round it raised in mid-2022.

The reduction comes even though ShareChat had a remarkably positive year, aggressively cutting expenses while managing to double its revenue. “When the market turned, we had to ease up [acquisitions and creator payments] “Moving towards more profitable growth,” Ankush Sachdeva, co-founder and CEO of ShareChat, told TechCrunch in an interview.

ShareChat did not spend money on user acquisition last year, with Sachdeva attributing improvements to the startup's content recommendation engine to boost user retention and engagement. The company has also invested heavily in AI talent, especially in senior roles in its London-based team. ShareChat also revealed that it has doubled the ESOP grant to every employee in the company as part of a special bonus grant.

He said it was also able to reduce its biggest expense, the cost of serving content. “When you bring in content on one of our apps, we do a lot of math to find the top 10 content. And to serve that and consume it, there's another delivery cost. Optimizing that has helped us reduce our burn.

ShareChat has reduced its monthly cash burn by 90% over the past two years while doubling revenue, attracting fast-moving consumer goods companies and large gaming companies as advertisers.

The startup also remains committed to the short video market in India, despite strong competition from YouTube and Instagram following the country's ban on TikTok in 2020.

“In terms of traffic, our traffic is less than Instagram and YouTube, but we are the largest in terms of standalone app,” Sachdeva said. He believes ShareChat's unique focus on live streaming as a destination for entertainment and communication between creators and users will set it apart from US competitors. The startup will acquire local rival MX TakaTak in a deal worth more than $700 million in 2022.