A measure of wholesale prices rose less than expected in March, providing some potential relief from concerns that inflation will remain higher for longer than many economists expected.

The producer price index rose 0.2% during the month, less than the Dow Jones estimate of 0.3% and not as much as the 0.6% increase in February, according to a statement Thursday from the Labor Department's Bureau of Labor Statistics.

However, on a 12-month basis, the producer price index rose 2.1%, the largest increase since April 2023, suggesting pipeline pressures that could keep inflation high.

Excluding food and energy, the core producer price index also rose 0.2%, matching expectations. Excluding basic-level business services, the increase was 0.2% monthly but 2.8% compared to last year.

The release comes one day after the Bureau of Labor Statistics announced that consumer prices rose again more than expected in March, raising concerns that the Federal Reserve will not be able to cut interest rates anytime soon.

On the producer prices side, March's gains were driven by services, which saw a 0.3% increase during the month. Within this category, the stock brokerage and other investment-related fees index jumped 3.1%.

Conversely, commodity prices fell by 0.1%, marking a 1.2% increase in February. Final demand energy costs, which have been on the rise recently, fell 1.6% during the month. However, wholesale final order prices of food and goods excluding food and energy rose by 0.8% and 0.1%, respectively.

Despite the increase in prices at gas stations, the final demand index for gasoline decreased by 3.6%. This contrasts with the Consumer Price Index, which showed gasoline rising by 1.7% on a monthly basis.

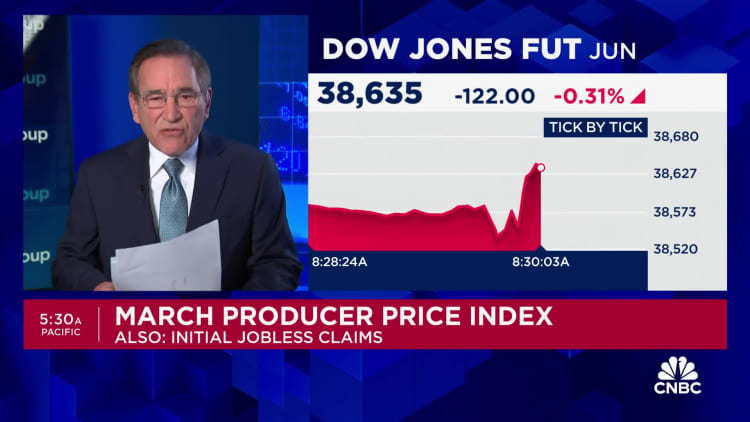

Markets showed little reaction to the data, with futures contracts linked to major stock indices rising slightly despite a decline in Treasury yields.

In other economic news Thursday, initial claims for unemployment benefits fell to 211,000, down 11,000 from the previous week's upwardly revised level and below the Dow Jones estimate of 217,000.

Continuing claims, which were delayed by a week, rose to 1.82 million, an increase of 28,000 during the period, according to a Labor Department statement.

Economic data points are being closely watched as the Federal Reserve considers its next steps on monetary policy.

The release of the Consumer Price Index on Wednesday shook markets, which had been anticipating a strong series of interest rate cuts this year. The report showed that the annual inflation rate reached 3.5%, much higher than the Federal Reserve's target of 2%.

The market now expects only two cuts will be possible this year, and that will likely not begin until September, according to CME Group data.