By the age of 30, Sam Bankman Fried had convinced a million people that he was the safe custodian of their hard-earned money.

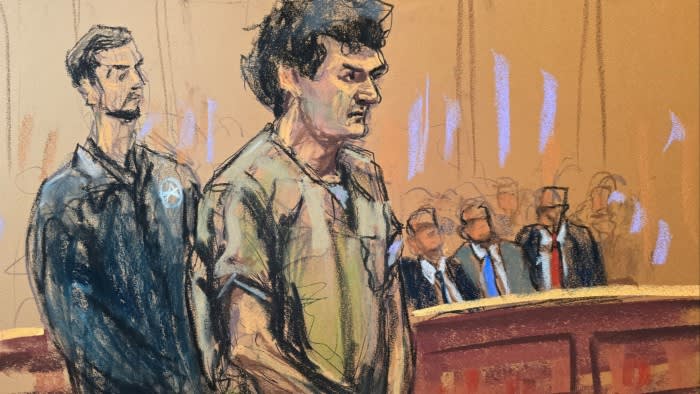

But as he stood in a Manhattan courtroom Thursday, his curly hair undone, the master of persuasion failed to convince the person who mattered most at that moment: a federal judge who would soon sentence him to a quarter-century in prison. behind bars.

The FTX founder, who has been embraced by figures such as former US President Bill Clinton and New York Mayor Eric Adams, “presented himself as the good guy, all in the interest of proper regulation of the cryptocurrency industry,” Judge Lewis Kaplan said. “In my opinion this was work.”

In fact, the offer by Sam Bankman and Fried played a major role in determining his fate.

In a two-hour hearing, Bankman-Fried's words came back to haunt him again and again. Kaplan turned the mood blue when he reminded the court of Bankman-Fried's assessment of his motives in comments he made to a reporter shortly after FTX's collapse. Bankman-Fried admitted that his public advocacy for stricter cryptocurrency rules was “just PR,” adding: “Fuck the regulators.”

“Bankman-Fried has made a lot of public statements before [the trial] “The court believes that demonstrated a complete lack of understanding of the seriousness of his crime,” said Rachel Memin, a former federal prosecutor in the office that charged the FTX founder, who now works for Lowenstein Sandler.

She added that the comments indicated that “he did not seem to realize the seriousness of his crime.”

As demonstrated by evidence presented at trial, Bankman-Fried's rehabilitation campaign was already in full swing in the hours before its FTX cryptocurrency exchange collapsed with an $8 billion hole in its balance sheet in November 2022, and continued for several months after that.

When FTX customers demanded to know what happened to their deposits, he sent dozens of tweets assuring them that everything would be fine, and directed others at the exchange to do the same. After being indicted, Bankman-Fried spoke with several reporters in an attempt to get his side of the story, telling his version of events to best-selling author Michael Lewis.

Bankman-Fried's decision to testify in his own defense at trial—a step not recommended by most management lawyers—also backfired spectacularly.

Not only did he fail to win over jurors with his account of FTX's collapse — he was found guilty after only a few hours of deliberations on seven counts of fraud and money laundering — but Kaplan concluded Thursday that Faried Bankman lied in his testimony about when he learned of the $8 billion hole. , illegal use of customer funds, among others.

Kaplan also relied heavily on comments Bankman-Fried made to his former colleague and ex-girlfriend Carolyn Ellison, who gave evidence at the trial.

Bankman-Fried described himself as “risk neutral,” the judge reminded the court, and recalled conversations about being “prepared to flip big coins” as long as there was some potential upside, even “if tails show and the world is destroyed.”

She also recalled Ellison's memory of Bankman Fried telling her there was a “5 percent chance” he would become president of the United States. Kaplan said this was evidence of Bankman-Fried's ambition to become “a person of great political influence.” [person] In this country.”

Even Bankman Fried's private musings were relayed to him, with disastrous results. Prosecutor Nick Ross pointed to contemporaneous notes made by Bankman-Fried after the FTX bankruptcy, which were submitted to the court before the ruling.

“His writings reveal a plan to relaunch FTX or something similar,” Ross told the court at Thursday’s hearing. “If Mr. Bankman-Fried believed the math was justified, he would do it again.”

Wedge Devaney, a former federal prosecutor who appeared before Kaplan, said the judge's comments indicated he viewed Bankman-Fried as someone with a cynical “Ayn Rand view of the world” who “should stay out of society for a while.” Of time.”

The community doesn't seem to be listening. During his short but impressive career, Bankman-Fried was the ultimate cryptocurrency evangelist, and FTX's goal was to make the technology accessible to the masses. His indictment and the company's rapid collapse were seen by many at the time as a fatal blow to the sector. Not so, as global cryptocurrency markets boom again.

Even as Ross decried the “extreme emotional and personal harm” caused by Bankman Fried in court on Thursday, the animal spirit of crypto remained undaunted. Bitcoin is once again trading at all-time highs. Millions of dollars have been poured into tokens such as Dogecoin, Shiba Inu, and Pepe, and the amount invested in recently launched cryptocurrency ETFs has surpassed $70 billion worldwide.

Sunil Kavori, a former FTX client who flew in from London to stress the impact the stock market crash had on him and others, seemed more preoccupied with the fact that he no longer had access to his crypto assets than his regret over investing in the sector for his startup. “It's our property, we're not unsecured creditors,” he told Kaplan at Thursday's hearing.

To crypto followers, Bankman-Fried was just a bad apple in a booming industry.

Recommended

“This trial is the conclusion of an unfortunate phase the market has moved on from. Enron was not proof that all energy markets were fraudulent, nor was it [Bernie] “Madoff is a benchmark for all hedge funds,” Michael Silberberg, of cryptocurrency hedge fund Alt Tab Capital, said after the ruling. “We believe in the strength of the cryptocurrency market and support the prosecution of bad actors.”

For the SBF, as it was widely known, even this assessment was not justified. The 32-year-old, who was helping tutor inmates seeking high school diplomas while awaiting his sentence, showed a hint of emotion when he told the court during a long speech: “I know how people look at me… and I understand why.

In the end, none of it was enough. “In this mathematical wizard’s mind… he saw the cost of getting caught, minus the likelihood or improbability,” Caplan, who has been on the federal court in Manhattan for 30 years, sums up, escaping without being caught. “That was the the game.”