Open Editor's Digest for free

Rula Khalaf, editor of the Financial Times, picks her favorite stories in this weekly newsletter.

Smith & Nephew wants to increase the pay of its US executives to bring them closer to US levels, with the head of the FTSE 100 medical devices company describing UK pay packages as “unsustainable”.

The company, which has had four CEOs in five years, on Monday published a package of changes to its pay policy as part of efforts to address high executive turnover.

Smith & Nephew's move is the latest sign that major UK-listed companies with a large proportion of overseas revenues will try to challenge shareholders' reluctance to approve a pay rise at this year's AGM season.

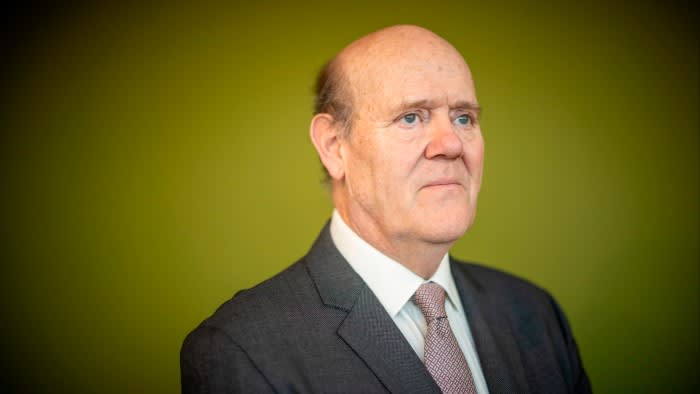

“There is a whole group of companies that I call Prilus: British only in listing,” Robert Soames, who took over as chairman of Smith & Nephew last September, told the Financial Times. These were “companies listed in London but with a relatively small portion of their revenues originating in the UK”.

Executives at listed groups are typically paid according to where the company is in its primary listing, so Smith & Nephew's CEO Deepak Nath, an American based in Fort Worth, Texas, is currently paid in line with his peers in United kingdom.

“The current situation with wages is actually not sustainable,” Soames said. The company's new policy would put US-based executives on a path to higher pay, in line with local competitors and different from the UK market, where its CFO is based.

Soames said the reform “is a sensible and practical way to deal with a problem where London-listed companies need to be able to recruit talent from markets around the world, and these markets have different practices.”

Other large UK-listed companies, including the London Stock Exchange Group, are preparing to seek shareholder support to increase UK executive pay by benchmarking them against their US counterparts.

The payment has been a source of animosity for Smith & Nephew. In October 2019, Namal Nwana resigned after 18 months as CEO because the company did not meet his salary demands.

“This is my payment, not [current] “CEO,” said Soames, who is also the new head of the CBI, a U.K. business lobby group. “The board is faced with the reality of being a company where the weight of the medical technology market is in the US and where all the COOs – the leadership of the company – pay taxes, are citizens of and live in the US.”

Smith & Nephew was founded in Hull 168 years ago and has grown to employ 18,000 people in around 100 countries. The UK represents just 3% of its revenue and 7% of its employees, while more than half of its revenue comes from the US. Nearly all of its senior operating managers, including its CEO, are U.S. citizens and residents of the United States.

Recommended

London's stock market is facing questions about its international competitiveness after a series of companies with large operations in North America, including betting group Flutter, building materials group CRH, packaging company Smurfit Kappa and plumbing supplier Ferguson, decided to withdraw from the FTSE 100 index. For the first time. Listed in the United States.

“We are not considering moving the initial list to the United States,” Soames said. “Why would we want to move our core roster unless there was a compelling reason to do so?”

Smith & Nephew's share price has fallen 8.3 per cent over the past 12 months and is up 1.6 per cent this year.

Under the new pay policy, Nath is set to receive up to $11.8 million next year if all targets are met.

The package will include a new restricted stock plan worth 125 percent of salary, over three years. Nath's maximum bonus under the company's long-term incentive plan, which is linked to performance, will rise from 275 to 300 per cent of base pay.

The package will be put to a shareholder vote at the company's annual meeting on May 1.

“The reception among investors is more open now than it was two years ago,” Soames said. “Everyone in the UK has a stake in a booming London market, and I think people would be really concerned if they saw the London market continuing to lose market share and want to do something about it.”