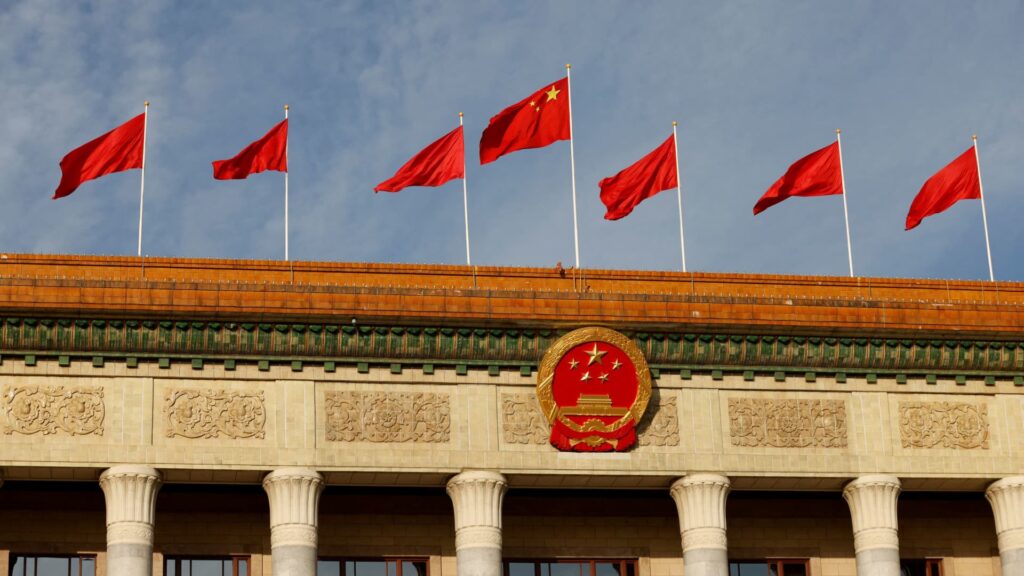

The Chinese flag flies over the Great Hall of the People before the opening ceremony of the Belt and Road Forum (BRF), celebrating the 10th anniversary of the Belt and Road Initiative, in Beijing, China, October 18, 2023.

Edgar Su | Reuters

BEIJING – China is scheduled to begin its annual parliamentary meetings this week, which investors are closely watching for signs of economic stimulus.

The country's GDP grew by 5.2% in 2023, but the overall recovery from the Covid-19 pandemic has been slower than many expected. A prolonged slump in the huge real estate market and a decline in global demand for Chinese exports have contributed to lower levels of consumer and business sentiment.

All of this has led to questions about whether Beijing will intervene with widespread support. So far, the authorities have remained relatively conservative.

Wang Jun, chief economist at Huatai Asset Management, said Beijing indicated in December that any new policy support would be “appropriate,” adding that it was “impossible” for the stimulus to be as large as it was in 2008. This is according to a translation CNBC. From his remarks in Mandarin.

China's economic policy is usually decided at an annual meeting held in December by leaders within the ruling Chinese Communist Party.

The meetings this month, known as “two sessions”, are held at the government level, rather than party, and usually release more details about policy plans, such as this year's GDP target.

Wang said he is monitoring comments on the authorities' plans for the real estate sector, capital markets and local government finance.

Back in 2008, when the world was suffering from the financial crisis, China launched a massive stimulus package to support growth while increasing demand. While the economy has rebounded, these measures have drawn criticism because of the resulting rise in local government debt.

In recent years, Beijing has stressed the need to stem financial risks and clamp down on real estate developers' heavy reliance on debt for growth, an issue linked to local government financing. This time, China's monetary policy also faces restrictions related to the extent to which it can deviate from the path of interest rates adopted by the US Federal Reserve.

GDP and other economic objectives

The Chinese People's Political Consultative Conference, an advisory body, is scheduled to begin its annual meeting on Monday.

The Legislative Council of China's National People's Congress is scheduled to begin its meeting the next day. Tuesday is also when the Prime Minister is expected to share the year's targets for GDP, employment and other economic indicators in what is called the “Government Work Report.”

“The target is likely to remain relatively high,” said Zong Liang, chief researcher at the Bank of China, noting that gross domestic product grew by 5.2% last year. That's according to a CNBC translation of his Mandarin remarks.

The fiscal deficit target is expected to be around 3.5% and monetary policy will also be relatively loose.

In October, China made a rare announcement that it had decided to raise the fiscal deficit to 3.8%, from 3%.

“We expect the budget deficit – which excludes private bonds, political bank bonds and local government finance instrument debt – to range at 3.0%-3.5% of GDP, narrowing from 3.8% last year,” said Louise Law, chief economist at Oxford. Economics, in a report on Thursday: “of GDP.”

“We expect a modest increase in the share of local government special bonds (LGSB), to CNY4.0 trillion from CNY3.8 trillion last year,” Lu said. “Authorities may also finally put pen to paper on the CNY1 trillion in planned central government special bonds (CGSBs), reflecting the increasing role of central treasuries amid the ongoing debt clean-up among local government entities this year.”

“Overall, the additional fiscal stimulus this year, assuming no bazooka-like fiscal package emerges, is unlikely to be particularly significant.”

View reviews on real estate and technology

The two sessions are also a period for budget release and for delegations to discuss necessary political changes and plans.

“Speeches by senior policymakers will be key to the follow-up, including interviews with key ministers, such as the Minister of Industry and Information Technology, the Minister of Science and Technology, and the Minister of Housing, Urban and Rural Development. These key ministers will discuss various policies in more detail,” Goldman Sachs analysts said in a report. .

During the parliamentary meetings, Chinese officials are also likely to discuss plans to boost technology and innovation, in line with a recent high-level call to boost “new productive forces.”

The Foreign Minister and the Chinese Prime Minister usually hold press conferences during parliamentary meetings. The advisory body is scheduled to conclude its annual meeting on Sunday, March 10, according to an official announcement. The National People's Congress is scheduled to conclude its work the following afternoon, Monday, March 11.

The Bank of China's Zhong expects policymakers to send signals about opening borders or other business opportunities to foreigners, as well as improving the environment for non-state-owned enterprises.

However, specific implementation details are usually left to individual ministries to announce, following high-level guidance from Beijing.

Any direct support for consumption is unlikely, but broader moves to improve the social safety net would be noteworthy.

“On the demand side, the third plenary session was delayed [of the Chinese Communist Party’s Central Committee] “(Originally scheduled for December) suggests that longer-term demand policies – including fiscal, tax and pension reforms – may still be in the early stages of discussion, but could still be worth mentioning here,” Lu said.

Overall context

This year's two sessions follow regular reshuffles at the leadership level, which have strengthened the ruling Chinese Communist Party's control over the government.

At last year's parliamentary meeting, Beijing announced a sweeping reform of finance and technology regulation by establishing party-led committees to oversee the two sectors. Chinese President Xi Jinping, who is also the party's general secretary, has secured an unprecedented third term as president.

Key leadership positions in China's government or party are not scheduled to change this year, while the United States is scheduled to hold its presidential election in November.

Since last summer, Chinese authorities have already announced a series of policies to boost growth and acknowledged the need to increase confidence. Critics say these measures are relatively fragmented.

Recent economic data indicate a mixed picture of growth, with some improvement in the manufacturing sector, but the real estate sector is at best only stabilizing.

Huatai's Wang expects the economy to gradually recover this year, and that in contrast to last year, nominal GDP will be better than real GDP. This means that the noticeable improvement this year will be more tangible for consumers and businesses.