This article is an on-site version of our Moral Money newsletter. Sign up here to get the newsletter sent directly to your inbox.

Visit our Moral Money hub for the latest ESG news, views and analysis from across the Financial Times

Good morning from New York.

Yesterday, the Stockholm District Court approved the bankruptcy application of Renewcell, a Swedish startup that produces clothing from recycled textiles. Clothing giant H&M was among Renewcell's investors, as the Financial Times reported in 2019. I mention this in part because of the topic of today's newsletter, which focuses on finding cleaner materials for ubiquitous consumer products made of plastic.

Concerns about the Great Pacific Garbage Patch, and concerns about the amount of microplastics we ingest, have increased commercial opportunities in seaweed and bioplastics. But these startups face major challenges in expanding their product range to combat the plastic problem. Will they survive?

Thanks for reading.

Plastic alternatives

Addressing obstacles to greater uptake of bioplastics

For toy maker Lego, the “magic” of oil-free plastic never materialized.

Last year, the family-owned Danish company abandoned its plan to replace petroleum-based plastics with recycled materials in its world-famous bricks. The announcement came two years after Lego announced it had made significant progress in its attempt to move away from petroleum-based plastics through recycled beverage bottles.

“It was a belief [would be] It's easier to find this magic material or this new material that will solve the sustainability problem, Nils Christiansen, LEGO's CEO, told the Financial Times last year. “We tested hundreds and hundreds of materials. It was not possible to find a material like this.”

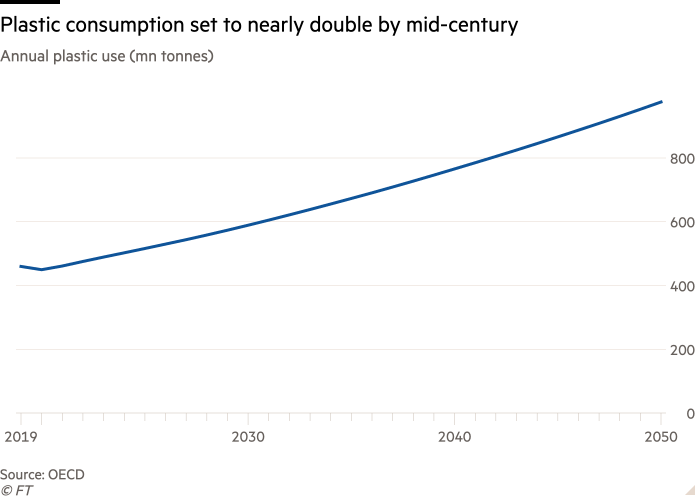

LEGO's failed attempt underscores the fact that plastic is a cheap — and often unavoidable — part of everyday life, and it's also dangerous. The OECD said in a report last year that the life cycle of plastic generates about 4 percent of total greenhouse gas emissions. Worse still, there is alarming evidence suggesting that humans and animals are ingesting a harmful amount of plastic. People now consume up to five grams of microplastics per week through food, drink and polluted air, according to a 2021 study.

As these issues increase demand for biodegradable plastic alternatives, companies are turning to seaweed as an alternative. New York-based Loliwear raised $6 million last year to make biodegradable straws and other alternatives to single-use plastics. London-based Notpla has partnered with food delivery company Just Eat Takeaway to make biodegradable seaweed packaging. Earlier this month, Sway, a California-based seaweed packaging provider, announced a $5 million fundraising round to expand its product range. Julia Marsh, co-founder and CEO of Sway, told me the company has deals with clothing companies Burton and JCrew.

Other materials derived from corn or potatoes have been tried in the field of bioplastics. Sugarcane bioplastics have been making waves in Brazil for more than a decade. But those sources require more land and fresh water, two ingredients that don't pose a problem with seaweed, Marsh said.

Sway products “replace some of the most common and harmful everyday petroleum products that have not only polluted our pristine, vibrant natural lands, waterways and oceans, but have also been confirmed to have penetrated our human bodies to harmful and deadly effect,” said Jason Engel, co-founder of Third Nature Investments. , an impact investment fund and investor in Sway.

But bioplastic companies that use seaweed face some challenges, Martin Mulvihill, managing partner at Safer Made, an investment fund that specializes in companies that work to remove and reduce harmful chemicals in packaging, told me. He said seaweed does not work like plastic in food packaging, which must be sealed to pass regulations.

but, “[for] Mulvihill said of the seaweed alternative, adding that he was familiar with Sway but had not invested in the company. He said IKEA is interested in seaweed packaging for the small bags it uses to wrap screws. He added that airlines and hotels are also looking for alternatives to products that do not require stringent safety requirements.

Other challenges faced by bioplastics' competitors include the entrenched relationship between the plastics industry and major oil producers, which rely on plastics as a major source of income.

China's high consumption of petrochemicals continues to drive demand for oil. “The speed and scale of expansion in China’s petrochemical sector exceeds any historical precedent,” the International Energy Agency said in December. China is set to add as much production capacity for ethylene and propylene – the two most important building blocks of petrochemicals – as there is currently in Europe, Japan and Korea combined.

In November, oil-producing countries were accused of obstructing the first international agreement on reducing plastic pollution.

“Big oil companies are betting on plastic to save themselves,” Marsh said. “There are a lot of incentives to make it easy and keep using the same material.”

But there are regulations in the pipeline to limit the use of single-use plastics. New York City this month introduced legislation banning the sale of clothes washers and dishwashers that use polyvinyl alcohol, with the goal of reducing microplastic pollution. The American Cleaning Institute, a US lobbying group representing BASF, Clorox and other companies, criticized the New York legislation.

The European Union has adopted a plastic reduction target by targeting bags and coffee cups. Beverage bottles must contain 25% recycled plastic starting in 2025, increasing to 30% in 2030.

Packaging waste in the EU increased by about 20 percent between 2009 and 2020 – a much faster rate than the bloc's economic growth – to an average of 177 kilograms per capita, despite increased recycling.

From Lego bricks to laundry detergent pods, consumers are demanding more sustainable options than plastic. As well-known brands get involved in these products, and regulators tilt the playing field toward bioplastics, venture capitalists and other investors are beginning to see the value of plastic alternatives. Combined, these three forces may offer hope that bioplastics companies can survive to challenge the dominance of traditional petroleum-based plastics.

Smart reading

I recommend this story from our colleagues at Energy Source about rising profits at the largest U.S. oil and gas producers even as the industry laments “hostile” policies from the Biden administration.

Newsletters recommended for you

FT Asset Management – The inside story on the movers and shakers behind a multi-trillion dollar industry. Register here

Energy Source – Essential energy news, analysis and insider intelligence. Register here