An essential first rung on the ladder of the home to acquire process is actually choosing just how much it’s possible to spend. It count may be centered on of a lot points, but also for people the initial would be how much you could potentially secure to possess a home loan. As you initiate investigating hence lender is right for you, it is possible to certainly hear a couple equivalent-group of sentences continually: pre-qualified home loan and pre-acknowledged financial.

So, what is the difference between getting pre-eligible for a mortgage and you will pre-recognized to possess a mortgage? Let us discuss just how per is also place you inside the a better position to make an offer on the dream home.

Precisely what does Pre-Approved getting home financing Mean?

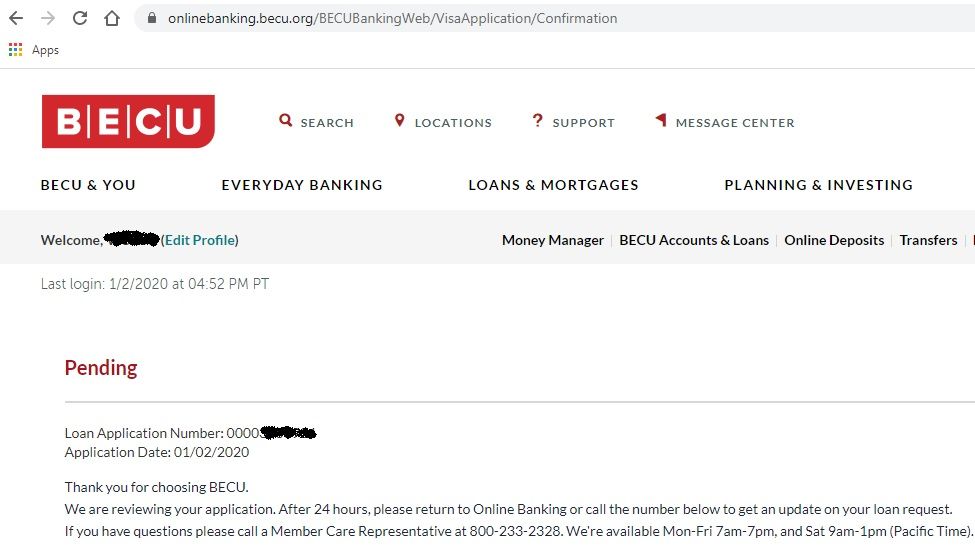

Getting pre-accepted to own a mortgage are a comparable however, a far more in-depth techniques than simply pre-degree. You’ll answer the new lender’s questions about income, debts, and you will possessions, however, this time around they’ll pull your credit report and request papers to confirm everything. This may are lender statements, W-2s, 1099s, pay stubs, and prior tax statements.

In the event the everything you checks out, the lending company will pre-agree your to have a mortgage loan. You’re going to get a beneficial pre-recognition page, that is good to possess a certain amount of big date, and you will demonstrably states simply how much you are acknowledged so you’re able to obtain and the interest rate we offer.

Which have this pre-acceptance page makes the property process convenient. Sellers usually get also provides regarding consumers that pre-acknowledged a great deal more surely than simply consumers who are not.

Pre-Accepted or Pre-Qualified: Which is the Best choice to you?

The procedure of to order a property is difficult. Mortgage pre-approval and you can mortgage pre-qualification are two gadgets that were designed to ensure it is convenient much less tiring. For the correct choice for you, it simply utilizes and that phase of one’s payday loan Iliff techniques you are in.

In reality, you ple, when you find yourself during the early degrees and only dipping your toe in the industry, pre-degree is fast and simple and will help you narrow brand new desire of one’s search. Once you have acquainted oneself with the domestic once its listed, home loan pre-recognition offers the capability to disperse easily.

Consider this that way. Pre-degree is meant for your requirements. Pre-acceptance is supposed to possess sellers. For those who have good pre-recognition page to show a home merchant, they says to them you to definitely a lender is ready to offer the latest savings wanted to make the transaction.

Get Pre-Qualified otherwise Pre-Acknowledged with Man’s!

Mans Area Federal Borrowing Partnership offers amazing rates and outstanding buyers solution among its players. Before you go first off the mortgage application for the loan techniques, check out you. We’ve been helping the brand new Clark Condition WA area for over 70 ages.

Mortgage Pre-Degree and you may Pre-Acceptance Faqs

When you find yourself pre-approved, meaning the lending company provides affirmed all documentation and you will is ready to provide a mortgage. They leave you a letter that assistance the lead to when you happen to be prepared to generate a deal to the a home. Although not, it is critical to just remember that , pre-approval does not mean you’ve been approved. The financial institution should re-be certain that all the info in the event that financial is needed. The borrowed funds are going to be declined if one thing has evolved significantly once the the information is provided. Yet not, for as long as all of the data is similar to that which you in past times given, there can be good options it will be acknowledged.

If you get pre-entitled to property, your discover how far banking institutions are able to provide you with and you can at the what rate of interest. This is not a partnership to offer the loan if date arrives. What is to try to make you a definite picture of exactly what your spending budget are. You ought to however pertain and start to become approved towards mortgage.

Without pre-qualification, it can be hard to recognize how much is available so you can you. It indicates you could potentially become looking for domiciles beyond their finances, which can lead to dissatisfaction and you will squandered time. Therefore while you don’t need to score pre-entitled to a loan upfront looking at belongings, i suggest it.