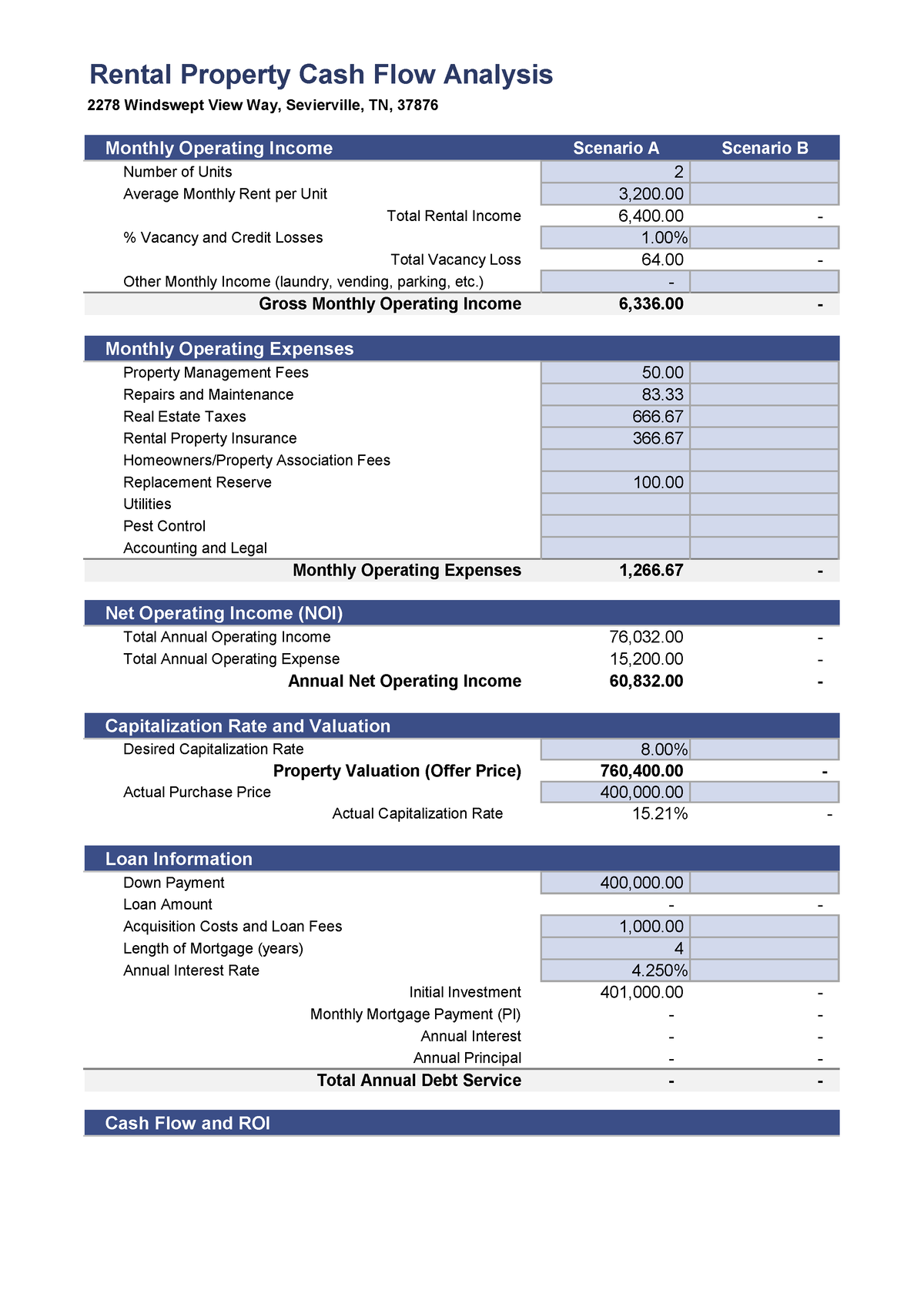

- The price of the house

- The fresh new advance payment number

- The loan name (the duration of the borrowed funds)

- The possibility financial rate of interest

- The amount of assets taxes due annually towards the assets

- New projected cost of home insurance

- Any extra fees, instance people connection (HOA) fees or PMI

Borrowers also can look for a mortgage broker to enable them to shop doing and acquire the best complement all of them, otherwise they could discover mortgage lender studies on line to see which of those would-be a great fit

Because the customer enters this article to the mortgage calculator, they’ll certainly be capable of seeing the estimated payment. They’re able to after that play around into the number to see if they could afford increased mortgage, reduce fee, or faster financing label considering its current economical situation. This particular article can assist them determine how much home loan capable be able to accept, that’ll help them get a hold of a property that can fit into its finances rather than challenging the profit.

Second, your house customer would want to look at the different varieties of mortgage loans and decide and that mortgage they would like to make an application for. If the the credit score and you will deposit amount be considered all of them to possess a conventional mortgage, they will certainly likely have a wider collection of lenders of which in order to rating home financing. In the event the, but not, the customer provides a fair credit score and you will a decreased down percentage, they , like the FHA (Government Homes Management), USDA (U.S. Company off Agriculture), or Va (U.S. Company regarding Veterans Factors). Within this scenario, they might keeps a far greater directory of choices which have lenders who specialize in almost any sort of mortgage these are typically trying to find.

Step one for almost all individuals for taking when looking for an informed mortgage brokers (for example PNC Financial otherwise Quality Mortgage brokers) is always to do an on-line identify mortgage lenders near me personally. not, instant same day payday loans online Ohio it is necessary getting borrowers to adopt federal lenders and online lenders also local possibilities like credit unions or regional banking companies. Local lenders iliarity on the housing market within urban area, nonetheless is almost certainly not capable promote once the reasonable a keen interest rate since national or on line lenders.

Step: Prepare issues to have loan providers.

You will find several crucial concerns to ask a home loan company you to individuals will want to bear in mind. First, might need certainly to request what types of mortgage loans the fresh new financial also provides. Should your borrower already have wise of whatever they envision they’d particularly, they are able to say so-right after which ask what other possibilities is readily available that they might not have felt.

2nd, brand new debtor will want to ask possible loan providers in the interest levels, settlement costs, taxes, mortgage insurance coverage requirements, prepayment charges, or any other fees to provide all of them a concept of precisely what the financing will definitely cost all of them. Borrowers may also must query the lender throughout the its conditions to have credit scores, down payments, and you will personal debt-to-money ratios (the amount of loans new debtor provides with regards to their month-to-month income).

In the long run, borrowers may wish to query perhaps the bank has the benefit of price hair. Financial rates are continuously changing, this can pay for individuals to view financial speed trend directly because they are getting ready to make an application for home financing. This could help them obtain the reasonable home loan speed and secure they during the towards lender if at all possible. Locking within the a speeds claims it to own a certain period of time. For as long as this new debtor can personal towards mortgage before the speed secure expires, you to definitely speed are going to be protected. not, the lending company you certainly will replace the rate in the event that you’ll find any big change on the borrower’s standing, such as for example a lowered down payment about what is actually in the first place arranged abreast of otherwise a primary change in new borrower’s credit rating.