You are making brand new Wells Fargo site

You are making wellsfargo and you can typing a web page you to Wells Fargo will not manage. Wells Fargo has furnished it connect for your benefit, however, doesn’t endorse in fact it is maybe not accountable for the merchandise, features, stuff, website links, online privacy policy, or coverage plan for the website.

Once you get a loan, loan providers assess the borrowing risk predicated on a great amount of affairs, as well as your borrowing/fee records, money, and you can overall financial situation. We have found particular much more information to help define this type of activities, known as new 5 Cs, so you can most readily useful understand what lenders select:

Credit score

Qualifying toward different kinds of credit hinges mainly on your own credit history – the new history you created if you’re dealing with credit and you can and make costs through the years. Your credit score is especially a detailed listing of the borrowing record, consisting of guidance available with lenders that have lengthened credit in order to you. When you’re advice may vary from a single credit scoring institution to another, the credit profile include the same type of pointers, such as the brands out-of loan providers that have expanded borrowing in order to you, type of borrowing from the bank you have, the fee records, and. You can get a free of charge backup of one’s credit file all the 1 year from each of the 3 major credit rating people (Equifax , TransUnion , and you will Experian ) during the annualcreditreport.

Also the credit history, lenders can also explore a credit score that’s a great numeric worthy of usually between three hundred and 850 according to research by the information present in your credit report. The credit rating serves as a danger sign into bank predicated on your credit report. Generally, the greater the fresh new score, the reduced the chance. Borrowing from the bank agency scores are called “FICO Scores” as the of numerous credit bureau score found in brand new U.S. are made of app created by Reasonable Isaac Organization (FICO). Although lenders play with credit scores to enable them to make their credit behavior, for every bank features its own standards, according to the number of exposure they finds acceptable for an effective given borrowing from the bank tool.

Ability

Lenders need determine whether you could conveniently afford your payments. Your earnings and you will a position records are fantastic indicators of your own element to settle the loans. Earnings amount, balance, and type cash get be experienced. The fresh new ratio of your own most recent and you may people the newest personal debt as compared into the just before-tax income, labeled as personal debt-to-earnings proportion (DTI), is evaluated. Learn more about DTI and use our loan calculator observe where you are and possess answers to preferred inquiries.

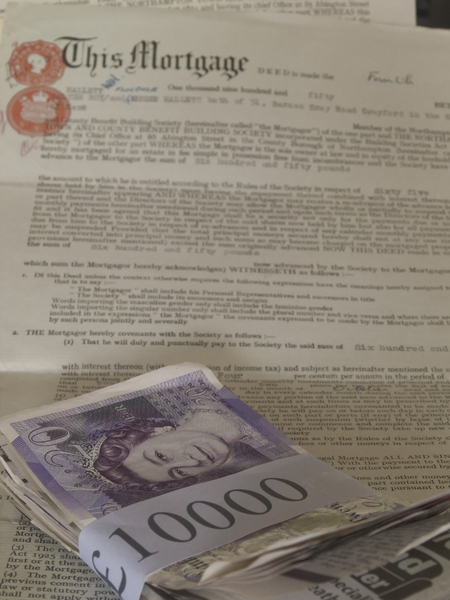

Collateral (whenever obtaining secured loans)

Money, personal lines of credit, otherwise credit cards you make an application for tends to be safeguarded or unsecured. With a secured device, instance a car or truck otherwise home guarantee loan, you vow something you very own because security. The value of your own security could well be analyzed, and you will one current obligations covered from the that guarantee would-be subtracted from the worthy of. The remaining collateral will play a factor in the latest financing choice. Keep in mind, that have a guaranteed financing, the latest possessions you guarantee since the collateral has reached chance 2400 dollar loans in Charlotte IA for those who usually do not pay-off the mortgage since concurred.

Financing

If you find yourself your loved ones money is anticipated become the main provider out-of cost, financial support stands for this new offers, investments, and other assets which will help pay off the loan. Then it useful for many who clean out your work or experience other setbacks.

Requirements

Loan providers may want to know how you plan to use the brand new currency and can think about the loan’s goal, for example perhaps the financing could be regularly buy a auto or any other assets. Additional factors, including environmental and you will economic climates, may also be thought.

The five C’s from Borrowing is a common term within the financial. Now you understand them, you could potentially better get ready for all the questions you might be questioned next time you make an application for credit.

Enable your self which have economic training

The audience is invested in working for you make your economic victory. Right here you can find a variety of a guide, interactive devices, standard methods, and – every built to help you improve monetary literacy and you can started to your financial needs.

You should be the key membership proprietor regarding an eligible Wells Fargo user account having an effective FICO Rating readily available, and subscribed to Wells Fargo On line . Qualified Wells Fargo user profile include put, financing, and you will borrowing from the bank accounts, but other consumer profile can certainly be qualified. Contact Wells Fargo to have details. Availableness can be affected by your own mobile carrier’s visibility area. Your cellular carrier’s message and you may study rates may pertain.

Please be aware your rating offered less than this service is for academic objectives and may even never be the newest rating utilized by Wells Fargo and also make borrowing conclusion. Wells Fargo discusses many things to determine your credit options; ergo, a particular FICO Get or Wells Fargo credit history does not verify a specific mortgage rate, recognition out-of a loan, or an update towards the a charge card.